How financial organisations can understand data at scale with GenAI

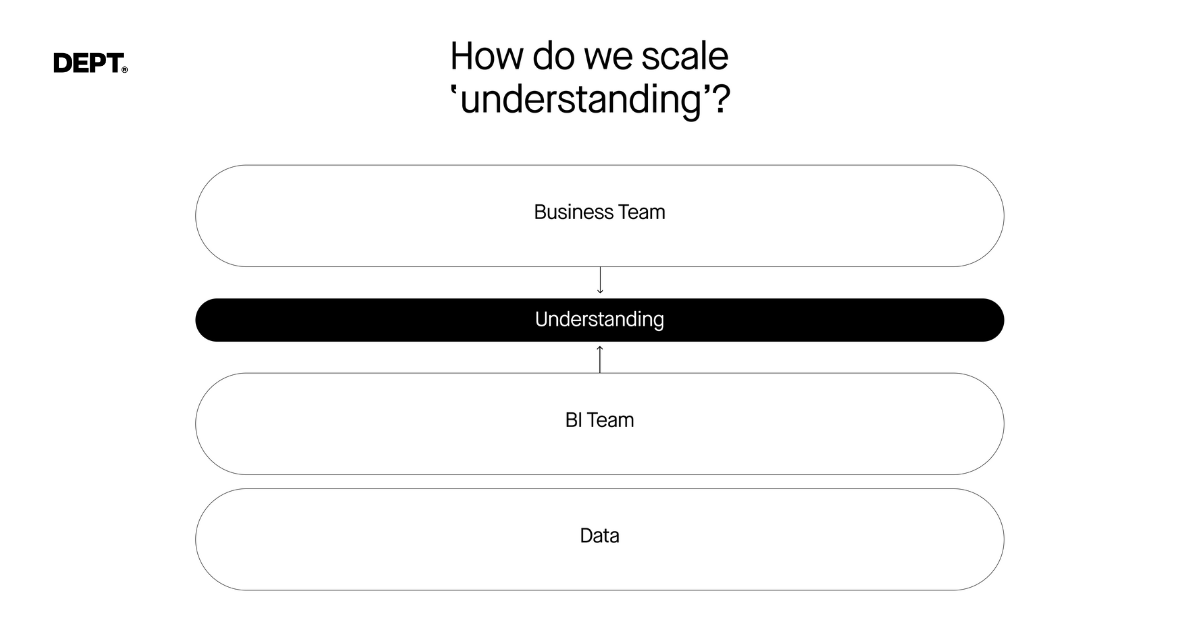

Moving beyond self-service

While self-service data access is great, it is not enough in an age of so much data.

Data understanding requires your team to access data, understand its nuances, and derive meaningful insights. This is where GenAI can come into play. By building an “understanding” layer into your data reports using large language models (LLMs), you can enable computers to find structure from language and enhance data comprehension.

In this way, GenAI can help you scale your understanding of data. LLMs can process and interpret complex queries, allowing you to gain insights from data without being limited by your technical expertise.

This level of data understanding empowers employees to make informed decisions and take actions based on data-driven insights.

A Conceptual Web layer makes data accessible

The Conceptual Web™, facilitated by GenAI, makes ideas accessible, searchable, and understandable at scale. Employees can engage in natural language conversations with the system, asking questions and receiving contextual responses.

Here’s an example:

Question: What is ‘default rate’?

Clean session response: Default rate refers to the percentage of borrowers who fail to repay their loans or credit obligations, resulting in a loss for the bank.

Question: What is ‘default rate’?

Seeded with schema response: In the banking database you have provided, default rate can be determined by analysing various factors, such as: customers who have missed multiple loan payments within a specific timeframe, an increase in the number of delinquent accounts or loans, or customers who have a history of bankruptcy or foreclosure.

Question: What is ‘default rate’?

Seeded with default rate query response: Default rate in this context is calculated as the percentage of loans that have not been repaid within a specific period.

Question: What was our default rate last quarter?

Response: Our default rate for the last quarter was 2.5%.

This example system provides various responses, ranging from a general definition to specific patterns indicating default rate in a bank. This accessibility and scalability of knowledge helps employees explore data and gain deeper insights.

Smart investments in GenAI

In a year where GenAI is the biggest disruptor, it can be tempting to jump into head-turning AI products. But especially for BFSI companies, where organisational readiness impacts innovation, we think this is the best place to invest in and learn about GenAI. It meets our criteria for smart investments in AI:

- High impact: The possibility of drastically higher revenue or reduced cost

- Low risk: Start with internal systems that are well structured with highly trained operators to limit your exposure

- Involves communication: LLMs are good at language. Choose a system or process that requires heavy communication.

Starting with well-structured internal systems limits risk and increases the likelihood of successful implementation. Plus, helping individuals be self-sufficient in data understanding can lead to improved decision-making and innovative ideas down the line.

This could be the year where you shift from business intelligence to an intelligent business.