Marketplaces have earned a reputation for facilitating a fast, transactional relationship, fulfilling supply and demand in the most efficient way. Though this strategy fundamentally clashes with luxury retail brands’ approach to affinity marketing, all types of brands have flocked to marketplaces as a tactic to keep business afloat during store closures and supply chain disruption. The onus is now on the luxury sector to find creative ways to adapt to new boundaries.

In the first quarter of 2020, Amazon reached the $1 trillion market cap, as Q1 net sales rose 26% to $46bn. At the same time, UK high street retailers including Debenhams, Beales, John Lewis and Harrods were announcing job losses and store closures. It’s the end of an era, not only for some of Britain’s longest-standing department stores, but also for the brands that rely on retail concessions.

With commerce beginning to stabilise, it’s a great time for businesses to re-evaluate their marketing plans and contemplate if the decisions made during a period of crisis will withstand. Marketplaces offer a great solution to start selling online with a straightforward onboarding process, but are they the right way forward for luxury businesses? Can brands in this space find a balance between generating high volume sales, whilst continuing to develop brand equity and customer loyalty? The answer is yes – and we’ll explain how throughout this article.

It’s almost never a straightforward solution when it comes to luxury e-commerce. As consumer expectations continue to evolve, an increasing number of brands are activating marketplaces to enhance their commerce strategy. Continue reading, as we review the top three ways marketplaces are lifting luxury brands to the next level of e-commerce.

How to use marketplaces as a marketing platform

1. Mainstream marketplaces amplify reach

Taking into account how much Amazon and other leading marketplaces spiked during the first quarter of 2020, individual shops on those platforms should have also been performing exceptionally well. If you were an existing seller, how does your level of transactions compare to this time last year or the previous period? If you’re a new shop, have you surpassed targets? If so, by how much?

Essential and low-value items, where factors like price-point and next-day delivery, are key to purchasing have historically dominated the top marketplace, but there are other ways for retailers to gain value from Amazon. Don’t forget, it’s by far the most visited e-commerce website, with enormous amounts of traffic that just keeps growing.

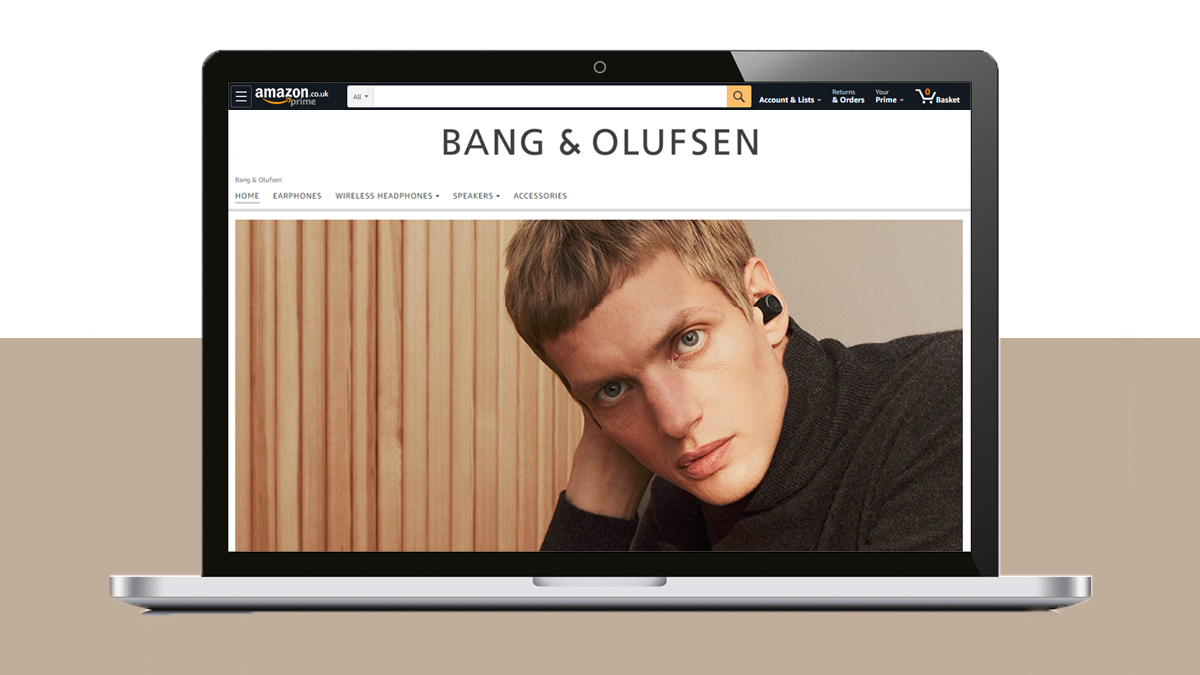

Historically, it’s been difficult for luxury brands to stand out in a sea of sameness; within a confined parameter, displayed in a grid format among the 353 million products currently listed on Amazon. But the marketplace has now released A+ and A+ Premium pages for store owners to better communicate their advantages with a storytelling page design. This functionality, partnered with onsite optimisation and advertising capabilities, is being utilised by more luxury brands to cleverly unlock the value Amazon provides.

High-end Danish consumer electronics company, Bang Olufsen is a leader in customer experience both in-store and from a storytelling point of view. And they’re also one of the top sellers on Amazon. If Amazon continues to evolve new functionality for different types of sellers, there could be more opportunities for luxury on the platform to create the ultimate one-stop shopping experience.

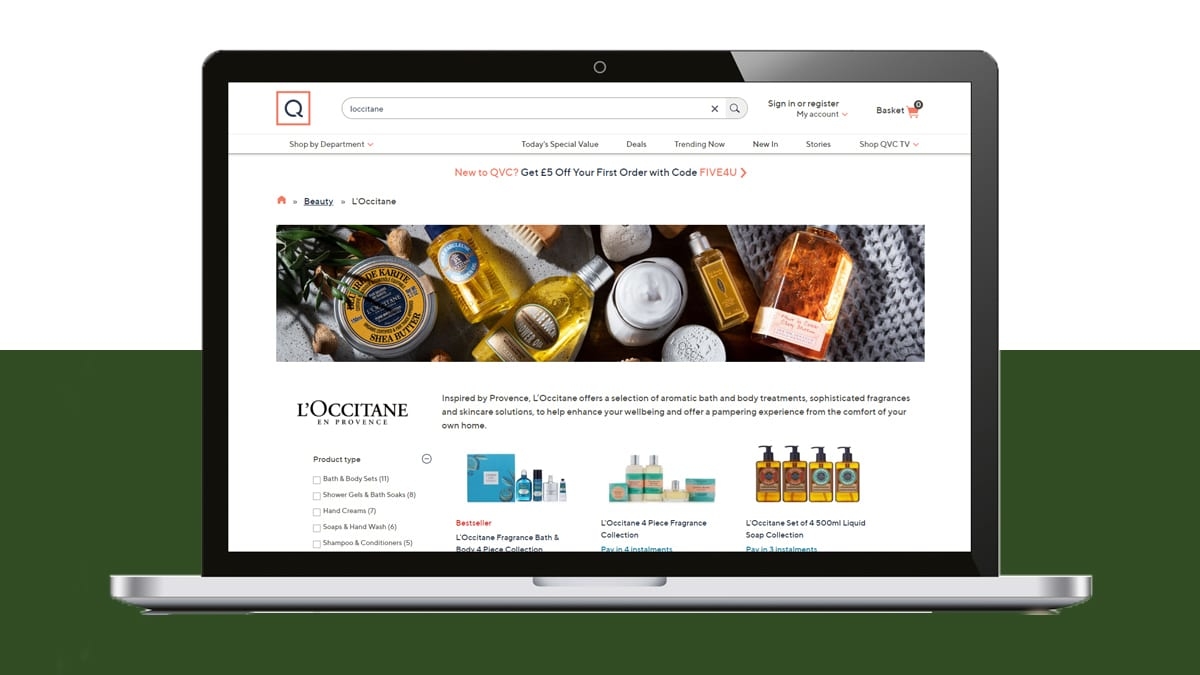

QVC home shopping network is a great comparison to Amazon, where products are highly exposed and bought on impulse, or out of convenience. Founded in 1986, the shopping channel now broadcasts to 350 million households in seven countries. In the UK alone, its website records over 1 million active customers annually, with 8.6 million viewers and 1.3 million unique visitors each month.

QVC continuously bolsters its brand to meet today’s consumer needs, and has evolved into one of the world’s largest multi-platform retailers. Through harnessing the power of influencers, social media shopping and e-commerce, QVC continues to attract a roster of iconic brands, from Apple to L’Occitane, Dyson to Lulu Guinness.

QVC strategically segments collections; a tactic to effectively tap into various sectors and product ranges through customising its tone and distribution channel to engage defined groups of buyers. In turn, a network of well-performing niche marketplaces have been created (such as electronics, beauty, jewellery), to operate simultaneously whilst benefiting from the reach and reputation of its overarching group.

2. Niche marketplaces engage target audiences

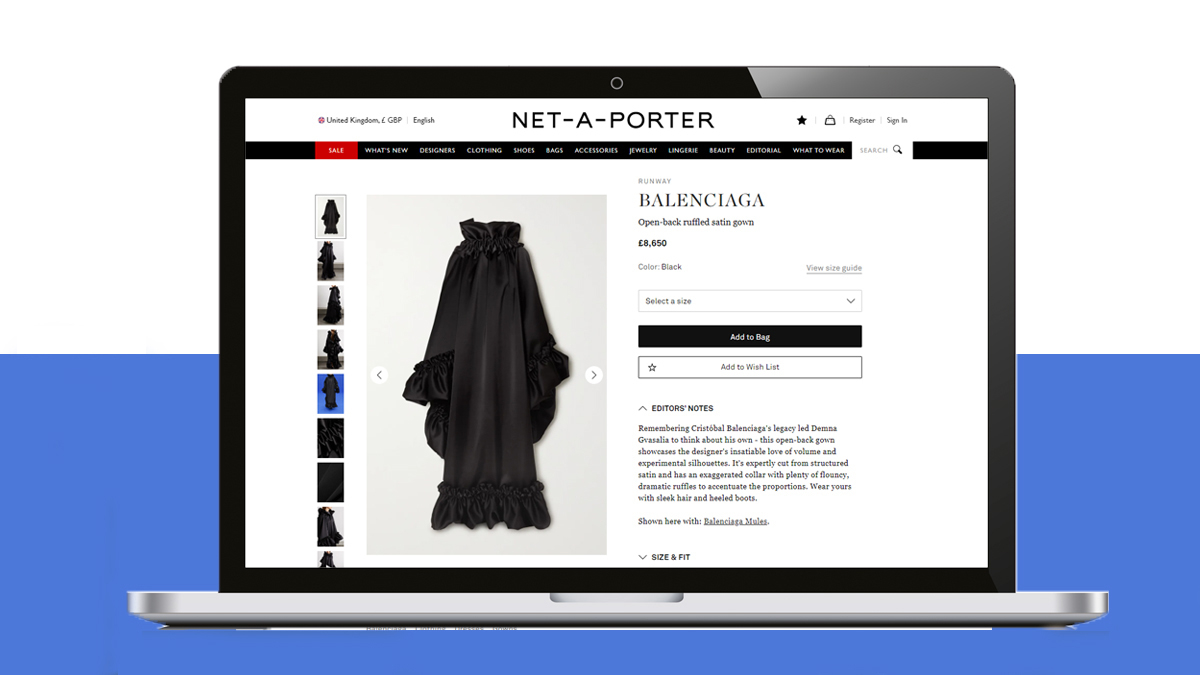

NET‑A‑PORTER, headquartered in London, is a pioneer in online, luxury fashion for top designer labels. The marketplace fuses content and commerce with unrivalled editorial across its print magazine, digital and mobile presence. Its platform includes inspirational interviews with women around the world, combined with glossy photoshoots that customers can shop directly from. The marketplace has attracted more than 800 of the world’s most coveted designer brands, including Gucci and Prada, cementing its position as a premier shopping destination.

In 2019, Federico Marchetti, the CEO and Chairman of NET‑A‑PORTER’s parent company Yoox group told Vogue, “We sit on a gold mine of data, with plans to integrate data into every part of the business with a strategy to improve technology, logistics and customer service.” Part of this plan includes releasing a white-label solution for customers to access the global inventory on its website, through an ‘omnistock’ system which will permit users to relocate inventory on demand, leading to fewer overstocks and out-of-stocks.

NET‑A‑PORTER is breaking ground with personalisation technology and facilitating new opportunities for its brand partners to accelerate their customer service.

3. Marketplaces display products in innovative ways

YooxMirror was launched in 2018 as the first AI-powered virtual styling suite. Fronted by a fashion-conscious avatar, Daisy, it’s designed to target millennials. New functionality now enables consumers to develop their own 3D personalised avatar, by taking a selfie or uploading a photograph. Users can create outfits to see how clothes and accessories would look on them, as well as share their favourite looks with friends on social media.

ASOS has launched its first augmented reality feature on its app Virtual Catwalk, offering customers a new way of viewing its products. By pointing their device at a flat surface and clicking the “AR” button on the product page, a model will appear “in front of them” wearing the product. Customers are able to view what products would look like on different size models so that they can get an idea of how an item might fit their body shape. The feature is also available on Google Assistant, allowing customers to shop with their voice. ASOS continues to experiment with new technology, and has since introduced an artificial intelligence-driven Fit Assistant to help customers get the right size the first time.

Wayfair’s app is making it much easier to visualise home decor improvements ahead of purchase. It features ‘View in Room 3D,’ which lets users take a photo of their room and then see various products added virtually in place. The technology understands the spatial information of the room in the image, giving the user an AR-like experience. On the Apple App Store, Wayfair is rated #8 in Shopping and currently has a 4.8 star rating from 875K users, which indicates how popular it is.

Express brand bravery

In defining your online merchandising strategy, consider your customers’ needs first by evaluating how they interact with your brand, its products and their preferred route to payment. Gather this data and overlap it with business requirements and opportunities available. Get creative with your own market research and test new distribution channels your brand may have disregarded in the past.

Time and attention should be taken to select a marketplace that reflects your brand’s market position. Stocking products on the shelves of a storefront isn’t the only consideration for business owners; it is imperative that products get supplied to customers in a practical and ethical way that matches a company’s ethos. The same level of deliberation should be taken when listing your products through an online third-party.

Marketplaces shouldn’t be considered the saving grace for brands to start selling online, but rather a working cog in a much larger e-commerce marketing strategy. A well-established brand hub should be the focal point of all your actions; creatively expressing the brand’s key value proposition and USPs in the most authentic way. This is the avenue to control your storyline and create a pulse for your brand.

Continuously building this narrative evokes a response every time customers interact with the brand. Though customers may forget what you say, they won’t forget how you made them feel, which is key since emotions drive purchases more than logic. By taking a storytelling approach on your owned channels, your brand will become more memorable in a crowded market.

Turn customers into a loyal tribe. When using third-partying retailers, encourage customers to visit your brand pages, enabling you to create a connection and re-engage with them in the future. It’s understandable if brands can’t keep up with the technology innovation global marketplaces are releasing, so don’t try to compete with them. Join them, and look to introduce technology in new ways to tell the story of your brand.

More Insights?

View all InsightsQuestions?

Managing Director