How to use Amazon’s new-to-brand metrics

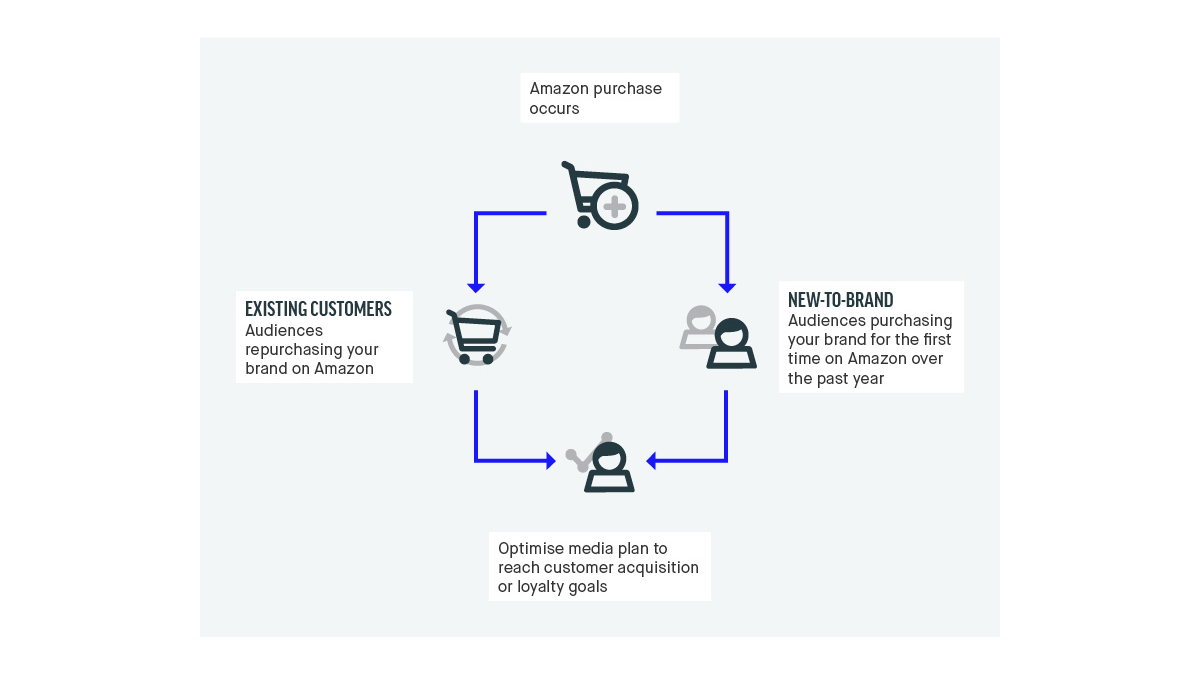

Amazon has introduced New-to-Brand (NTB) Metrics for Sponsored Ads and the Demand Side Platform (DSP) in recent weeks. The new key figures help you measure which of the sales generated through the campaigns can be attributed to new or existing customers. This information was previously unavailable.

You can use these new metrics to measure and optimise campaigns that target new customers. The same applies to marketing measures aimed at increasing customer loyalty and targeting existing customers.

You can also analyse the cost to acquire new customers across the channels. Based on the data gained, future marketing measures can be better planned and new customer targets can be reached more efficiently.

Who counts as a new customer of a brand?

In order to determine which Amazon users are new customers of a brand, the retail giant views their purchase history. First-time buyers are classified as users who have not purchased a product of the brand on Amazon over the past 12 months. This model not only considers sales attributable to ads according to Amazon’s attribution model but also organic sales. New customer data can be retrieved retroactively until 1 November 1, 2018. If you select a date before this, the start date will automatically be set to November 1 during the calculation.

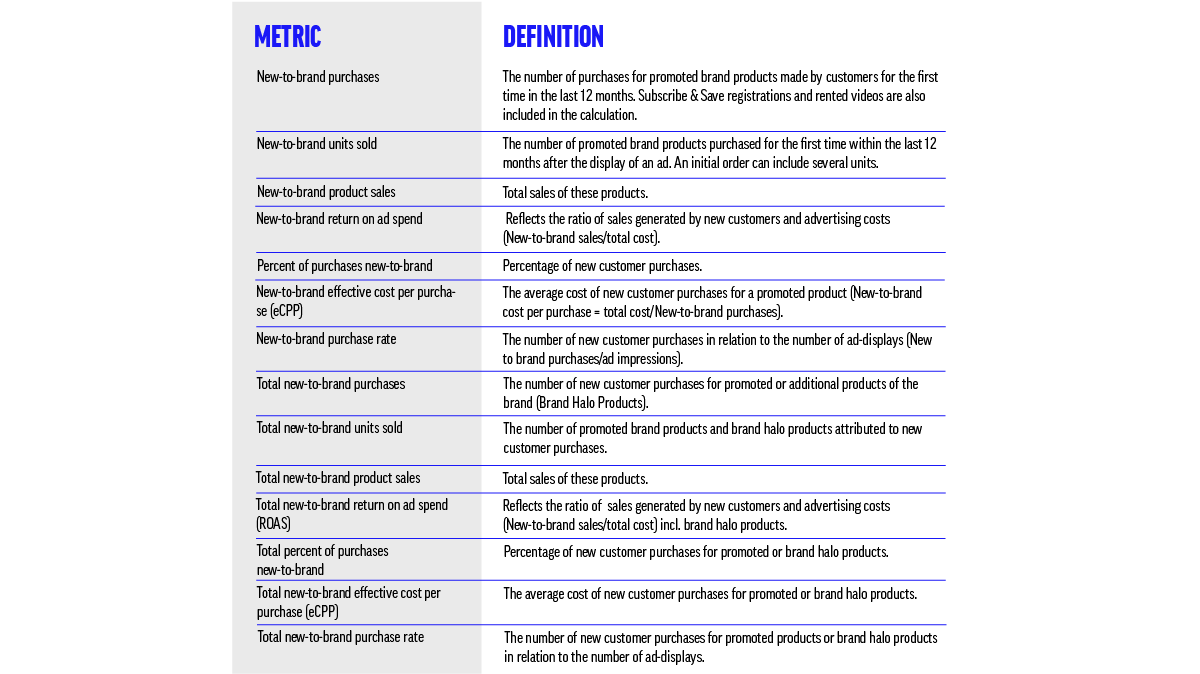

Overview of new-to-brand metrics for the DSP

In the case of Sponsored Ads, advertisers have four new customer metrics available. With DSP, the choice is much more diverse. The available key indicators include:

The new New-to-brand metrics can be found in the downloadable reports, Campaign Management Dashboards, and Performance Dashboards.

How to use the new new-to-brand KPIS

There are different ways to use the new key figures. One option is to optimise DSP campaigns to gain new customers.

If sufficient data is available, optimisation can begin. In order to accomplish this, you must look at the available new customer metrics and analyse which line items have the highest percentages of new customer orders (percentage of New-to-brand purchases). Ads should run for at least 14 days to collect a meaningful amount of data before the criteria can be adjusted.

Various factors can influence why line items achieve a comparatively high proportion of new customer purchases. These include, for example, the targeting orientation and the ad design. Another possible criteria is the supply source. Do some supply sources, such as the Amazon Shopping App, third-party apps or Open Exchanges, perform better than others?

Using cost-per-click metrics such as the New-to-brand eCCP, New-to-brand purchase rate or New-to-brand ROAS, marketers can measure and compare how efficiently new customer acquisition can succeed through DSP measures. It is important for the optimisation to constantly monitor the performance of DSP campaigns and, if necessary, to adjust the criteria.

Combined use with Amazon audience insights

Brand manufacturers are often faced with the question of which campaign strategies actually provide meaningful options. Audience Insights, available via the DSP, combined with New-to-brand metrics, provide marketers with the opportunity to make informed decisions.

Audience Insights is a DSP dashboard that provides information about the true target audience of a brand on Amazon. The collected information includes, for example, demographic data and the distribution of purchases and visits over certain periods of time.

The calculation takes all Amazon products associated with the brand into account. Whether orders or visits are based on Amazon Advertising measures or organic sales, does not matter. All traffic sources are accumulated.

In particular, the information about the order frequency is helpful in the New-to-brand metrics context. Here you can see the percentage of single and repeated orders over the last 13 months.

Based on this information, manufacturers can decide if they want to focus on finding new customers and increasing their market share, or if they want to focus on their existing target audience and strengthen customer loyalty.

Brand awareness, retargeting or loyalty?

The choice of strategic goals determines the strategy of the Amazon advertising campaigns and the distribution of the budget:

- If the goal is to gain new customers or market share, the budget should be allocated to brand awareness campaigns. Amazon uses first-party information to find potential customers who have shown interest in a category based on their surfing behaviour.

- Retargeting shows ads to Amazon users who have visited a product detail page, but not yet converted to customers.

- If you want to increase the number of your regular customers, it is advisable to invest in both brand awareness and retargeting campaigns.

- If your goal is to turn Amazon users into customers or repeat customers (strengthening customer loyalty) by targeting users who have already purchased a specific product or a branded product (so-called Brand Fans), then a “Loyalty” retargeting campaigns should be used.

Many manufacturers make the incorrect assumption that their order frequency is high and want to push their budget towards loyalty campaigns. If the order frequency proves to be low in reality, brands are usually unpleasantly surprised. They have not been able to retain customers.

Audience Insights allows manufacturers to assess whether budget redistribution towards loyalty campaigns makes sense. If the proportion of repeat buyers is high, it may be worthwhile to increase the budget. On the other hand, if it is comparatively low, you may want to use broader DSP customer targeting options.

If a brand has few new customers, it may be necessary to work with brand awareness and retargeting campaigns first. The aim is to acquire new customers who can be transformed into existing customers. A budget redistribution towards loyalty campaigns would not be effective in this case.

Remember, it is important that the promotional materials fit the respective campaign goal and are designed accordingly. This includes the choice of format, design and call to action (CTA).

Outcome

Advertisers now have the tools they need to assess the costs of attracting new customers to Amazon, as well as identifying the most efficient channels and tactics to achieve their campaign goals. For example, before the introduction of the New-to-brand metrics, advertisers found it difficult to provide justification for the use of brand awareness campaigns and measure their success. They often work with metrics such as Detail Page View Rate (DPVR) or Click Through Rate (CTR). However, these figures did not indicate for a long time whether ads were actually reaching new customers. The KPIs of the past have been replaced and budgets can now be allocated more efficiently.

More Insights?

View all InsightsQuestions?

Partner