eMoney

Transforming the future of financial planning

eMoney Advisor provides technology solutions and services that help people talk about money. Rooted in comprehensive financial planning, eMoney’s solutions strengthen client relationships, streamline business operations, enhance business development and drive overall growth.

To date, more than 75,000 financial professionals across firms of all sizes use the eMoney platform to serve more than 4 million households in the U.S.

Wealth management and financial planning services have rapidly grown since the 2008 financial crisis, and the industry continues to evolve. While traditional financial planning services have been designed to serve older, wealthier audiences, the demand for planning among Gen X, Y and Z, and other socio-economic demographics, has never been higher.

eMoney recognized that in order to drive sustainability and growth, they needed to develop solutions to help financial professionals serve a more diverse audience who could benefit from financial planning services.

Connecting a new audience to financial planning

DEPT® assisted eMoney in bringing the idea of attracting younger clients to advisory relationships to life. We kicked off the project with intense ethnographic research to uncover the best opportunities to reach these new audiences. We interviewed millennials to understand their financial goals, needs and challenges, and to identify their perceptions and interactions with money. The research showed that younger generations shop for financial advice like any other consumer good. They do online research, talk to friends and use a variety of self-service apps. We also learned that there was an opportunity to teach younger generations how to better manage their money.

It was also clear in the research that millennials will require greater control, access and adaptability as they evaluate the benefits of a financial advisor. We saw a future where higher volume, lighter touch engagements with personalization would take the place of the annual check-in with your advisor. Advisors would need to meet these new clients where they are.

We distilled these observations into insights, potential opportunities and eventually idea creation. Together with eMoney, we came up with five concepts that could harness the opportunity to fill this gap in the market. We then kicked off a series of design sprints. Design sprints are typically a five-day process for answering critical product questions through design, prototyping and testing ideas with customers. Through a design sprint, we built out prototypes for the eMoney concepts and tested them with real users. It became clear that users gravitated towards one of the concepts more than others, which was a mobile app that could provide financial wellness advice and complement the existing eMoney software-as-a-service platform. This was the beginning of what became eMoney Incentive.

Additionally, and perhaps most notably, we learned throughout testing and development that Incentive appealed to a wider audience beyond millennials.

Creating a financial wellness app to encourage healthier spending and saving habits

eMoney’s vision for Incentive was to create an easy-to-use financial wellness app that encourages simple behavioral changes through awareness and education of healthier spending and saving habits. This was an entirely new product for eMoney, so before they could start building it, they had to gain buy-in from around the company. We supported the eMoney team in creating the tactical plan for bringing these new features to the market.

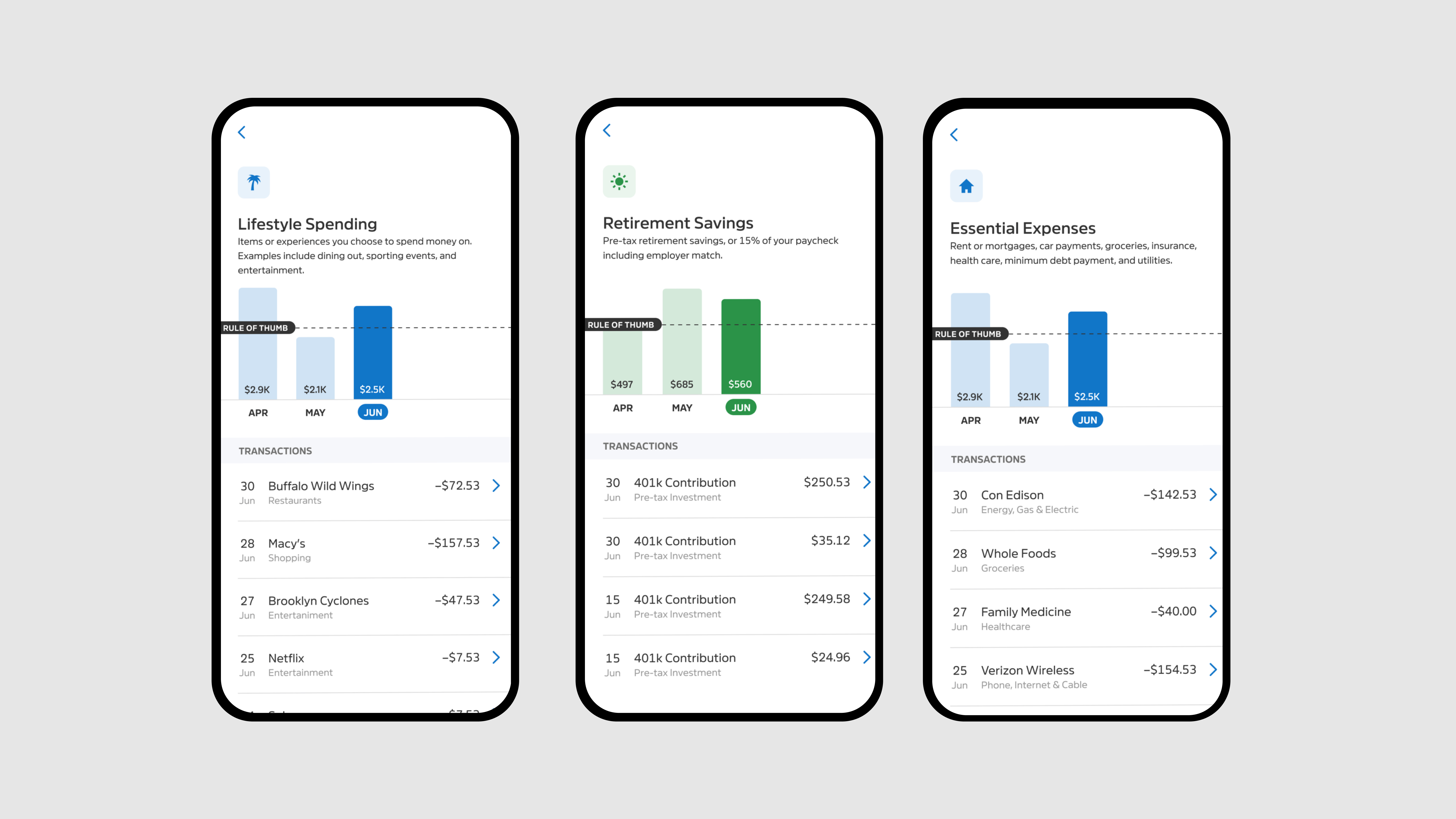

eMoney soon shifted into building mode. DEPT® brought additional mobile subject matter expertise to eMoney’s product development team to help bring eMoney Incentive to life. The eMoney Incentive app is a native app that allows Android and iOS users to better oversee their retirement funds, budgeting, emergency savings and even insurance coverage right from their phone. They can also sync bank accounts, credit cards and loans to get a more accurate view of finances in one convenient place.

Through the building and design process, eMoney saw an opportunity to expand its target market to anyone looking for financial wellness advice versus the younger, millennial audience that was part of the initial concept, and adapted the go-to-market strategy to focus on retirement plans advisors and HR departments at companies of all sizes.

There was also white space in the market for HR departments to be able to provide self-service financial tools as an employee benefit.

Driving growth and opening up a new market

Within six months of launching Incentive’s pilot program, eMoney created a strong pipeline of interested users, including current clients, retirement plan advisors and employers.

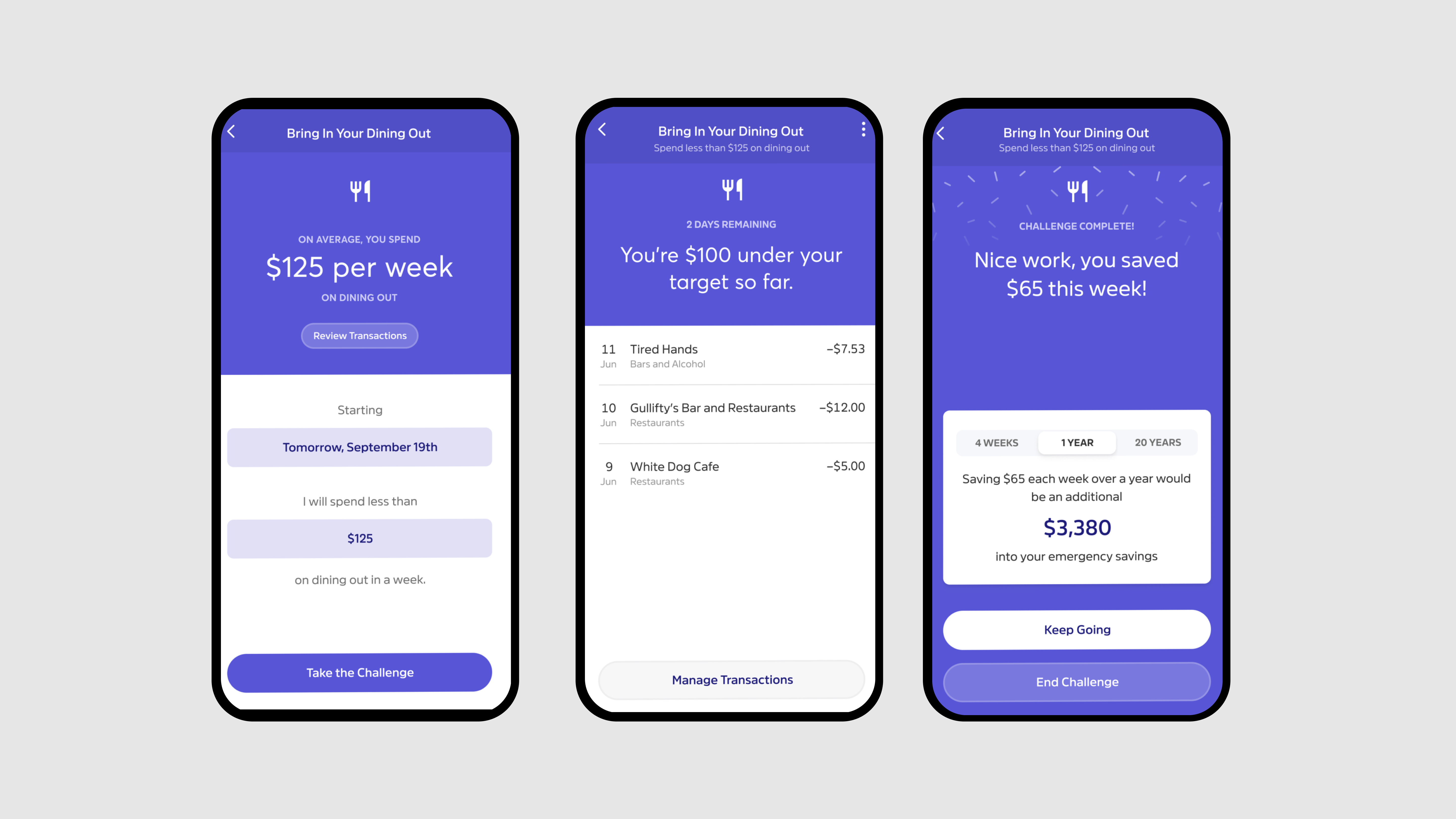

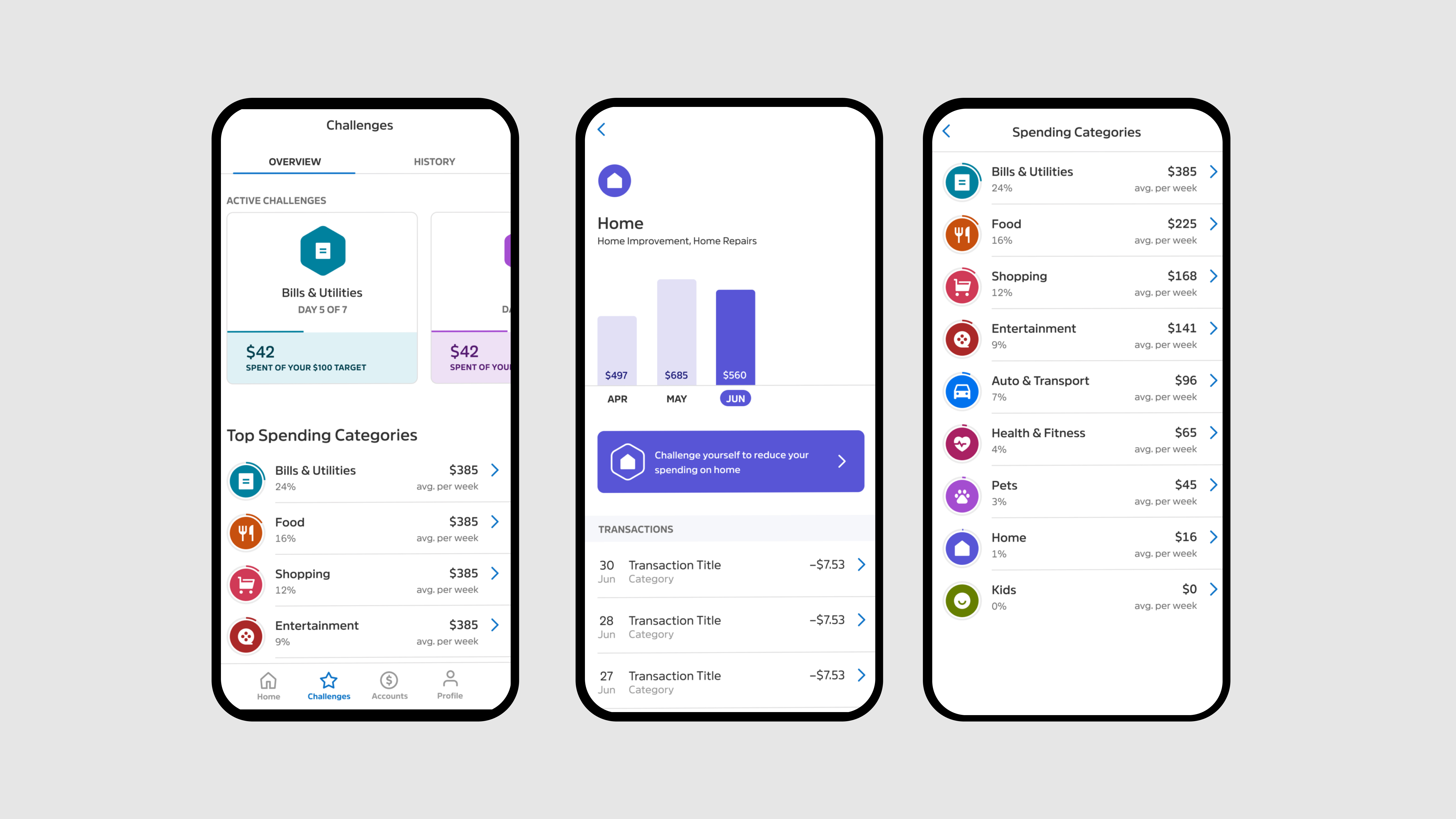

Since the beta launch, DEPT® has continued to support eMoney in making improvements to the app, including improvements to the “spending challenges” in the app. The app features a customizable challenge that allows participants to set their own savings goals as opposed to the pre-programmed challenges that existed in the first version of the app. Users can also see where they spend the bulk of their money and track spending trends over time.

In summary, this was a meaningful project for eMoney and DEPT®. For DEPT®, it was a chance to help eMoney build and launch its first mobile app. For eMoney, it was an opportunity to deliver on its company mission of “helping people talk about money” by providing solutions for a more diverse audience.

Questions?

Managing Director, Digital Products

Dave Witting

Discover more