How brands can get more value from personalisation [With Optimizely]

In today’s business landscape, personalisation is no longer a strategic choice—it’s a must.

As much as 76% of consumers say that personalisation is a key factor in their purchasing decisions. Additionally, personalisation has also been linked to a 50% reduction in customer acquisition costs and up to an eight-fold increase in return on marketing spend.

Despite the massive push across industries towards personalisation, however, over 60% of marketers are struggling with it. So, what makes personalisation so hard to get right?

Throughout our experience as an Optimizely Platinum Partner, we’ve identified three key areas for improvement.

Strategy: Planning for a marathon, not a sprint

One of the most common obstacles we’ve observed is the absence of a well-defined personalisation strategy. For personalisation to be effective, it needs to be applied and integrated across every aspect of your brand—from data to UX, design to technology.

However, while the overall impact of personalisation depends on how it is applied within these individual aspects, the direct impact on each one is tough to quantify. As a result, it’s all too easy for the specific initiatives around personalisation to lose priority as other business opportunities inevitably arise.

To secure comprehensive buy-in and justify continued investment in personalisation, it’s crucial to demonstrate its tangible value. It’s a good idea to begin with a few quick wins—such as those achievable through a DXP—where success can be measured through a set of predetermined KPIs.

Once you’ve accomplished those quick wins, it’s time to pull back and create a strategic approach based on continuous refinement and expansion. Sophisticated solutions like Optimizely Visitor Groups and Optimizely Content Recommendations help make this process surprisingly easy.

- Optimizely Visitor Groups offers a number of inbuilt capabilities that you can use to create variant content blocks that are adjusted automatically based on who is viewing your brand’s site and when. By taking into account criteria like time of day and whether or not a given user has visited other pages on your site, you can foster relevance and browser intimacy.

- Optimizely Content Recommendations gives you the ability to effectively index your brand’s content, providing users with an AI recommendation of content based on what their browser is viewing in real-time. By continuously recommending relevant content, this solution maintains users’ interests much like “Discover” tabs on social media do, helping reduce bounce rates from your brand’s site.

As you gain deeper insight into the customer journey and a more granular understanding of your customer base, you can hone your strategy even further to manifest exponential improvements in customer engagement, conversion rates, and growth.

Skills & teams: Creating a unified front

Another significant hurdle brands encounter is the shortage of necessary skills and knowledge to execute personalisation campaigns effectively—even when they have the right tools and technology.

From an organisational perspective, for example, a siloed approach to personalisation can restrict knowledge-sharing and limit the scope of an initiative to the speciality of one department.

To drive the best results with personalisation, you need to establish a unified front. By assembling a multidisciplinary team with specialists from across the full spectrum of your organisation, you can work together to assess the full customer journey and create use cases for personalisation that address specific needs.

At the same time, it’s also important to build accountability into your team by assigning a designated person or group to oversee everyone’s efforts and ensure they remain a priority.

In this regard, Optimizely’s Content Marketing Platform can offer a valuable contribution to your brand’s multidisciplinary personalisation team:

- Optimizely Content Marketing Platform (CMP) is used to plan, build, and execute campaigns. Through a set of AI-enabled tools for generation, collaboration, validation, and more, CMP streamlines operations by helping teams monitor progress and maintain accountability.

Data: Fostering structure to gain insight

While businesses amass vast amounts of data, they often lack a structured method for extracting insights, taking meaningful action, and evaluating impact.

This is where the value of a Customer Data Platform (CDP) comes into play. Without one, the lack of structure will be reflected in the quality of your data. Even if you’re relying on multiple tools in lieu of a CDP, the lack of integration will lead to the same issue.

Ultimately, the bottom line is that achieving any significant value from personalisation hinges on a deep understanding of your customer base.

This requires going beyond basic demographics to truly comprehend your customers’ needs, behaviours, and preferences. This is where solutions like Optimizely Data Platform can make a huge difference in your customer comprehension.

- Optimizely Data Platform (ODP) is a CDP that provides real-time segmentation and an assortment of other inbuilt campaign mechanisms, all by serving as a single source of truth for collecting, organising, and analysing your brand’s customer data.

- Optimizely Campaign is one example of an Optimizely solution designed to integrate with ODP. By syncing Campaign with ODP, you can automate marketing campaigns and personalise them based on audience attributes.

Another often overlooked way of gaining this insight is through qualitative research, such as customer interviews and user testing.

Combining those qualitative answers with CDP-enabled quantitative data analysis empowers your business to construct a comprehensive customer segmentation strategy. This understanding facilitates the development of more targeted and impactful personalisation initiatives.

Unlocking the last mile of value

We collect more data than at any point in history, but businesses rarely have a systematic approach to crafting insights from data, taking meaningful action, and closing the loop by measuring the impact.

That’s why we’ve based our approach to personalisation around these four fundamental pillars: Data, Insight, Action, and Impact.

This approach uses a structured process to ensure you’re not only building an understanding of your customer base through data analysis and insight generation, but also implementing those insights strategically to create a measurable impact.

Ready to supercharge your own personalisation strategy? Learn more about our capabilities as Optimizely Platinum Partners.

Meet us at Opticon 2024!

We’ll be in London, San Diego, & San Antonio

More insights

The next stage of frictionless banking experiences: Aspiration & personalisation

Over the past decade…

Brands in all industries have obsessed with creating frictionless digital experiences. This is especially true for banking.

The idea of a frictionless experience began with simple optimisation techniques and exceptional UI. But as benchmarks are repeatedly set and met, banks must take the next step toward frictionless experiences—beyond a pretty interface.

The next wave of frictionless banking is focused on “How do you make banking feel so integrated into the customer experience that users no longer recognise they’re working with a bank?”

The future of the banking experience involves integrating financial institutions into people’s everyday lives. It’s no longer enough to be perceived as a secure institution to store money. For banks to succeed in the future, customers must see them as personalised advisers, helping them maximise time and money while reaching individual goals.

While this sounds challenging at face value, organisations can take incremental steps to move toward this new frictionless era.

Analysing friction

Every bank should participate in a recurring friction analysis, a workshop where you define friction touchpoints and explore how you might mitigate them.

This involves identifying pain points, bottlenecks, and areas of customer dissatisfaction across all your touchpoints—mobile apps, websites, physical branches, and even social channels. Bring user feedback, analytics, and customer journey mapping into it so you can understand the specific areas that need improvement.

During the friction analysis, focus on streamlining processes, simplifying user interfaces, and optimising the overall user experience. This probably involves reducing the steps required to complete transactions, eliminating unnecessary documentation, and improving self-service.

For example, customer handoff is a common moment of friction. If users open a new account at their local bank, they’ll probably access an app within a few hours. Can they log in to their new account with ease, or must they navigate a complicated process?

This kind of scenario mapping can help you find moments of friction and start to prioritise.

Creating a frictionless ecosystem

Once you’ve identified your areas of friction, you must take steps toward a connected ecosystem that integrates digital and non-digital channels. That means customers should be able to start a transaction on their mobile app, continue it on the website, and complete it at a physical branch without any disruption or loss of information.

To accomplish this, you’ll need technologies that enable real-time data synchronisation and seamless integration between channels, including robust backend systems, APIs, data management capabilities, and, most likely, a customer data platform (CDP).

A CDP allows you to collect, unify, and activate customer data from various sources in real time. Any interaction or transaction initiated on one channel is immediately reflected on other channels, eliminating the need for users to repeat information or start over when switching between channels.

For example, if a customer starts a mortgage application on your website but doesn’t complete it, you can send a reminder via your banking mobile app.

For non-CDP organisations, there are some scrappy but efficient alternatives. One is the common QR code, which can direct users to a specific URL on your website. Another might be creating a cookie and sending it linked via What’s App.

Bring aspiration into personalisation

The next step into frictionless banking is bringing aspiration into personalisation. In other words, how do you go beyond transactions and offer customers something more? How do you create an “aha” moment?

By leveraging AI and machine learning, you can analyse customer data and understand your customer’s financial aspirations, goals, and preferences—a powerful tool for providing savings plans, investment strategies, or rewards that align with your customer’s aspirations.

For example, if a customer is saving for a home, perhaps you proactively offer a mortgage that fits their needs. If a timely and relevant offer is made, they may expand their relationship with you and allocate more to your products and services.

Beyond obvious financial products, find out how you can fulfil a need, or enhance a new experience. For example,

- Help customers plan a weekend trip by showing activities and deals they can enjoy in a city.

- Encourage a customer who aspires to play more golf with deals on course reservations.

- Reward a movie lover with exclusive merchandise.

If you can help your customers achieve their goals and aspirations within a seamless digital ecosystem, you’ve created a frictionless experience.

Elevating CX in BFSI

The journey towards frictionless banking is an ongoing process that requires continuous improvement and adaptation. As technology evolves, new benchmarks will be set around frictionless experiences.

By continuously elevating your customer experience, you can ultimately improve engagement and share of wallet.

More insights

Personalisation at scale with Adobe, smart & DEPT®

When the new smart #1 car launched, they wanted to sell directly to consumers–a big change for the brand.

Their goal was to build brand awareness and entice early adopters. Throughout the campaign, we sought to capture leads by centreing the customer journey around search, social, display marketing, and email nurturing.

The result? Increased awareness across a variety of media, increased brand consideration, and increased purchase intent. 11% pre-ordered a #1, three times the industry benchmark.

Listen to the talk below from Adobe, about how smart and DEPT® worked together to drive these marketing wins and set the new standard for personalisation at scale. Featuring Praveen Kumar Sadhineni, Lead – CX CoE at Smart Europe and Yash Mody, CTO Global Adobe Alliance at DEPT®

The smart campaign from DEPT®

In 2022, smart went fully electric, rebranding as a leader in the EV market. To kick off this new era, they needed to create excitement around the unveiling, generate leads, and then ultimately convert those leads into pre-orders.

At the same time, they invested heavily in e-commerce. While select dealers would remain, they wanted to sell most of the cars online. This shift in architecture added extra complexities across their tech stack.

With two monumental changes happening simultaneously, smart needed a sophisticated digital marketing strategy and robust technology to support it. Learn more about what strategies we used to help smart transform into D2C.

As an Adobe platinum partner, we can help you personalise at scale.

More insights

Questions about Adobe?

CTO – APAC & DEPT® Adobe Practice

Yash Mody

The benefits of personalisation for B2B commerce

There is a tendency in the B2B e-commerce sector to look across to the top B2C brands and play down the applicability of the features and techniques that make their sites market leaders. The idea that stylish sites and flashy features only fit the B2C model, while B2B should focus on the bread and butter options to fit the typically measured and professional tone of voice that many B2B brands use. This is misplaced thinking, based on the division of B2B and B2C. In reality, there are businesses, there are customers, and there is e-commerce. Shopper psychology spans across each; the features that allow B2C brands to excel in the online space are there because they work. Chiefly, personalisation.

Personalisation has always played a role in commerce. In the past, personalisation existed in retail as an in-store assistant, and in industry as a sales rep that would build a relationship with the customer over time, learning their needs, their pain points and how they liked to conduct their business. These approaches have always led to a much improved buying experience; faster, easier and more accurate. But these relationships take time to build; it’s a long term process of listening, learning and responding. And while human-to-human contact is still very much valued, digital technology, data tracking and analysis can bear the load. When implemented well, personalisation can speed up sales cycles and nurture prospects into loyal customers.

Advancements in digital technology have radically cut the time it takes to understand each individual customer and provide a personalised commerce experience. This technology is widely available, often built in to your content management system; all businesses now have the ability to implement personalisation strategies into their marketing and commerce efforts. This is good news, seeing as smart personalisation engines used to recognise customer intent can lead to an average profit increase of 15%. The flipside to this, is that personalisation has moved from an added benefit of certain businesses to an expected feature across every experience. 33% of consumers abandoned a business relationship last year because of a lack of personalisation. This is a necessity, not a nice to have feature.

Utilising account specific data

When starting to think about how your business can use personalisation in its commerce sales funnel, begin by thinking about how the company can collect data about customers and visitors. It’s important to begin with data capture, as the implementation of features depends on the type of data collected.

For specific customers, data primarily comes through the account creation process: job function; past purchases; which pages they have previously visited on the site; their dwell time; on-site search history, and so on. If the current data collection on account creation is limited, build this out for future customers and consider requesting current users to update their profile with more information upon their next login. Rather than hiding the motive, make it clear that the company will be using the data for an improved, personalised shopping experience. This clarity will boost the numbers opting in to data sharing, as it clearly offers a mutually beneficial exchange.

Putting this in place, electronics manufacturer Omron was able to create a site that adapts to the needs of each visitor. By using information on the job function of each logged in visitor, the Omron site could dynamically adapt and funnel distributors, systems integrators, Omron employees and end users to the appropriate pages. This is a simple solution, using just one piece of data to adapt the site, but it has a major impact, with the ability to scale up personalisation based on further gathered information.

Making use of digitally automatically collected data

Thinking about data capture also means thinking about the information that is automatically collected when a user visits the site, whether logged in or not. Their location data, the search term that brought them to the site, their onsite user journey – all of this information can inform your personalisation approach. Personalisation based on this information is subtle, possibly unnoticed as the visitor explores the website. They may not recognise the personalised experience, but will come away thinking that the shopping experience was quick and easy.

This also applies to classic customer segmentations, a general grouping based around shared behaviours. Personalisation doesn’t always mean single individuals. These segmentations can be useful when thinking about broader data automatically collected by new visitors to the site, as the depth of information isn’t there to create an individual response. As an example, an electronic parts company could use site search data to establish a segmentation that prominently displays associated purchases to visitors.

With an understanding of how data is collected, your business can begin planning the execution. At this stage, think in terms of what can be done onsite and off-site. While it is easier to control the onsite content and design, focusing solely on the website can see businesses missing out on the opportunity to fine tune their contact with customers through advertising and direct messaging.

Dynamic content

Onsite, dynamic content is a useful tool to make use of. This is content that adapts based on the data that is fed into the CMS, whether it is account data, previous purchases, search terms, and so on. The most obvious use is often found in the leisure and tourism space; if a visitor clicks on a number of pages relating to Italian destinations, the site can adapt the background images on more general pages to show Rome, Venice and Florence.

In the B2B space, dynamic content can be used to display relevant information, based on what is known of the customer. If they have listed their job function as logistics, they can be shown contextual information on delivery times and options, while a member of the finance team will see more about pricing options and different payment plans.

Accelerating everyday tasks

Speeding up common processes is another use, particularly helpful when looking to keep long term customers engaged. There will be a number of actions that returning customers have to redo with each visit, the most obvious example being adding items to the basket.

This is particularly important for B2B commerce as orders can be large and complex, and customers are more likely to repeat their orders when compared to B2C. Improving reordering was a key feature when developing Brenntag’s new commerce platform, Brenntag Connect.

As a chemical distributor, Brenntag has a strict process when allowing new customers to use their service. Customers are typically placing large, identical orders, leading Brenntag to create an automation service that places repeat orders and provides relevant contextual information when customers need to make an adjustment. This is a clear indicator of why it’s important to remember that personalisation is not fitting to how customers buy, it’s fitting to how customers behave.

Supplying more information to upsell

When customers are returning to reorder from your company, there is an opportunity to upsell existing products and promote new ones. This goes beyond ‘customers who bought X also bought Y’. This form of personalisation should aim to suggest alterations and explain the reasoning, based on the specific customer’s order. Think of it as a digital representation of the sales rep relationship, understanding the developments in a customer’s business and reacting with new solutions.

It can also be developed into a website feature, an interactive problem solving flowchart or chatbot that allows visitors to input their problem or need and see what solutions the company would suggest.

Optimising site speed

Not every on-site personalisation improvement is interactive and clear for customers to see. Adding in predictive loading is one example, a feature that speeds up the load time for each page on your site based on similar customer journeys.

Customers may never realise that the site they visit uses predictive loading, but they will notice if a site is slow to load. Selling needs to be as smooth as possible; slow loading leads to a larger bounce rate. Installing features, like predictive loading, that uses the information gathered when analysing personalisation can ensure the process never stalls.

Off site-actions

Personalisation also applies to actions that the company makes off-site. Email is one area, automated workflows for customers that left the site without checking can bring them back, boosting conversion through reminders and specialised offers. This can similarly be used for surrounding purchases, following the frequency of repeat purchasing or the typical time it takes for a customer to branch out to a new product.

Also consider how the purchasing journey exists across different touchpoints such as apps, social media and face-to-face meetings. Is it easy to bring up the customer profile and optimise their order based on this information? This kind of integration creates a seamless experience, perfect for B2B’s longer, omnichannel purchasing journeys.

Facilitate an easier commerce experience

In each recommendation, the end goal of facilitating a faster, easier, more accurate commerce experience remains the number one priority. By hitting each aim, the business makes each customer more likely to checkout, more likely to return, and more likely to talk to people in their industry about how great purchasing from your business is. These improvements build up, a snowball effect that ultimately results in increased sales and larger, loyal customer base.

More Insights?

View all InsightsQuestions?

Managing Director UK

Brian Robinson

5 AI predictions for 2025

AI is reshaping everything—from how brands market products to how organisations hire talent.

For executives, it’s tempting to see AI as a magic wand for quick wins or a surefire competitive edge.

But here’s the truth: Successful AI initiatives aren’t built on hype. They depend on hard realities—like the strength of your data, the agility of your strategy, and how well you empower your people to work alongside it.

During the 2025 DEPT® Trends event, our team discussed how AI will transform businesses in the next year. But these transformations won’t just happen on their own. They begin by understanding how to make it work for your business in a meaningful, long-term way. So, let’s cut through the noise with five AI predictions for 2025.

Data is the unsexy truth about AI

AI is only as good as the data it runs on, and—spoiler alert—that data is not always glamorous. Building a rock-solid data foundation is the unsexy but essential step for any AI initiative.

Thanks to generative AI, 75% of organisations have increased investments in data management. Yet only 41% feel ready to scale their efforts. Why the gap? Issues like data privacy, security, and compliance are holding them back.

Here’s the thing: Every successful AI project starts as a data project. It’s the sourdough starter of your AI strategy. Get this right, and you’ll move from AI proofs of concept to real, scalable results.

If you’re only making one big move this year, make it modernising your data infrastructure. Consolidate your data, ensure it’s clean and compliant, and get it AI-ready. If you do this, your brand will be able to differentiate itself—not just by using AI, but by using it in ways that have an impact.

Search will never be the same

The search landscape dramatically transformed in 2024. Zero-click AI summaries are more prevalent, challenging traditional SEO approaches.

Google’s Gemini highlights how search engines are evolving to integrate AI-driven insights. These developments require you to rethink your search strategies, focusing on optimising content for relevance and visibility in an AI-dominated environment.

Staying ahead means understanding how search engines prioritise content and anticipating future shifts. Proactive strategies that leverage AI to analyse trends and refine search tactics will be essential for maintaining digital prominence in this evolving landscape.

In 2025, efficiency is table stakes

For years, brands have treated new technology like a secret weapon. “This is it. This is what will make us untouchable.” But AI doesn’t play by those rules. In fact, it’s not a differentiator—it’s a democratiser.

As AI adoption accelerates, efficiency and insights are now table stakes. Increased accessibility to advanced tools means competitive advantages won’t come from the AI tools you’re using. The real differentiators will still be the basics: understanding your brand purpose, knowing your customers inside and out, and finding creative ways to stand out.

AI is also breaking down the walls we’ve built around competition. Consider Perplexity, a small player disrupting search with a differentiated product in a Google-dominated market. Their secret? Internal focus, great ideas, and a tight team.

For the C-suite, the takeaway is clear: Don’t get lost in the AI arms race. Double down on what makes your brand unique. AI might level the playing field, but the game is still yours to win.

Personalisation at scale gets closer

Hyper-personalisation has long been heralded as the future of marketing, and recent advances in AI are finally making it achievable. The ability to deliver targeted, individualised content at scale is no longer theoretical—it’s within reach if you’re equipped with the right technology.

The challenge lies in infrastructure. Accelerated computing capabilities are essential for processing data quickly enough to generate real-time, hyper-personalised content. Additionally, your data must be clean, structured, and compliant to maximise AI’s potential.

Dynamic content optimisation and real-time targeting are poised to revolutionise marketing, minimising irrelevant messaging and improving customer experiences. Investment in GPU-accelerated platforms and data infrastructure is critical to unlocking these opportunities, ensuring your systems are ready for the next wave of AI-driven innovation.

AI as a collaborative work partner

Previous AI predictions were full of doom and gloom, but 1-1 replacement continues to be disproven. Instead, teams are finding new tools and methods to get work done. 75% of employees are using AI in their jobs, whether employers like it or not (and whether their employers know it or not). The problem with this is that it’s typically not deliberate or collaborative.

In 2025, you need teams to move from discrete use cases of AI to purposeful integration. Put an AI tool review process in place. Create official rules and conditions around employee use. Publish approved and prohibited AI tools in an easy-to-locate dashboard.

By embracing AI as a collaborative work partner and involving all teams, AI adoption will become faster and easier across your organisation.

DEPT® and Shopify partner to unlock tomorrow’s commerce possibilities

Global digital agency DEPT® today announced its new partnership with Shopify, a leading commerce platform, to unlock tomorrow’s commerce possibilities for today’s most pioneering companies.

This new partnership will combine DEPT®’s tech expertise with Shopify’s essential internet infrastructure for commerce to offer its clients an integrated solution that leverages technology and AI to support their business growth.

Solving the “multi/multi/multi challenge”

By combining DEPT®’s unique blend of technology and marketing services with Shopify’s scalable platform, this partnership enables brands to thrive by supporting the entire digital customer journey—from awareness and acquisition to platform design and backend integration. DEPT® has the capabilities and award-winning industry recognition to support a variety of clients, internationally and locally, boasting a proven track record with successful digital transformation experiences including for international brands like Diageo, Meyer, Pit Viper, and Cowboy Bikes.

In today’s complex digital environment, brands face the “multi/multi/multi challenge”—managing multiple brands, expanding into multiple markets, and engaging customers across multiple channels. These challenges can stifle growth, especially as businesses strive to deliver personalised, seamless experiences while adapting to new technologies like AI. Without an integrated strategy and the full capabilities to execute, brands risk falling behind in a landscape where speed and adaptability are crucial. The DEPT® and Shopify partnership is designed to tackle these complexities head-on, enabling companies to scale globally while maintaining local relevance.

“Over the past four years, Diageo has worked with DEPT® and Shopify to power our direct-to-consumer offering in the UK. This has allowed us to navigate complex financial and compliance requirements to enable sales in a tax-compliant manner. The speed to market provided by Shopify’s tools and the new features added to our online stores have significantly enhanced our customer offering

”Adina Iliescu, Global Digital & Technology Director, Consumer at Diageo

“Our global partnership with DEPT® empowers brands worldwide, enabling them to seamlessly harness Shopify’s innovative commerce technology alongside DEPT®’s AI-driven digital solutions to drive growth. As a leading commerce platform for brands of all sizes, Shopify is strategically positioned to deliver advanced, unified commerce solutions that support DEPT®’s clients in expanding their global reach.

”Ritu Khanna, VP of Partnerships, Shopify

“This partnership unlocks possibilities to deliver unparalleled value to our clients. By integrating our Commerce capabilities with Shopify’s scalable platform, we’re equipping brands to tackle the complexities of multi-brand, multi-market, and multi-channel engagement. Together, we’re not just providing tools but creating tailored Commerce solutions that empower businesses and drive growth for ambitious brands.

”Andrew Dimitriou, Chief Client & Growth Officer, DEPT®

Leveraging AI

With over 125 Shopify experts, DEPT® leverages its AI innovation accelerator and advanced AI tools such as Shopify’s growing suite of AI-powered tools to enhance personalisation, optimise operations, and streamline omnichannel commerce. This fully integrated approach empowers enterprises to scale across regions and markets while maintaining local relevance, allowing brands to grow their commerce business from a single, unified platform.

More insights

DEPT® is named one of Forrester’s 12 top Media Management Services Providers

The media world is changing fast—AI, personalisation at scale, and dynamic campaign optimisation are shaking things up, while the phase-out of cookies and the rise of retail media commerce and social commerce are giving brands both challenges and exciting opportunities.

CMOs aren’t just looking for partners to run campaigns—they need innovation. And that’s where DEPT® steps in.

We’ve worked with brands for many years to support their media strategy. Our creative and media practice has grown steadily and we’ve always believed we are well-positioned to help any brand drive growth thanks to our 50/50 tech and marketing capabilities.

This is why we are proud to join the ranks of the top media buyers globally according to The Forrester Wave™: Media Management Services, Q4 2024. DEPT® has been included in this Wave for the first time.

The report analyses the 12 most significant global Media Management Services providers across 22 criteria.

In the report, Forrester notes “The collapse of the traditional marketing funnel sets brand marketing and performance marketing practices on a collision course and opens an opportunity for companies to create better marketing experiences that match consumers’ nonlinear purchase expectations and drive higher ROI.”

Evaluation summary

Forrester evaluated 12 vendors across 22 criteria grouped into three main categories: current offering, strategy, and customer feedback. DEPT® received the highest possible score in the content production criterion which we believe is in recognition of our ability to integrate media and creative resources to deliver comprehensive, next-generation creative intelligence, automation, and production to build and scale marketing content.

We also scored among the second highest in the following criteria within the Current Offering category: media planning, communications strategy, performance media, commerce media, intelligence, analytics and insights, media measurement and attribution, influencer marketing, and media responsibility. We also scored among the second highest in the following criteria within the Strategy section category: vision, partner ecosystem, talent strategy, and global delivery strategy.

In its vendor profile in the report, Forrester states “DEPT® excels at integrating content with digital media via its AI-powered content automation platform, Lightspeed” and that reference customers validate our “competency in digital buying, performance media, media intelligence and analytics, as well as savvy, proactive, tenured teams.”

“When tech, marketing, and AI come together, great things happen. We’ve been in the media management game for a long time with our proven ability to blend creative and media to achieve results, but this is a nice milestone for DEPT®. We’re rightfully standing alongside some of the biggest names in the industry, managing over $4 billion for our global clients.”

”Dimi Albers, Global CEO at DEPT®

Pioneering the future of media

While we are newcomers to the Forrester Wave, we’ve been helping shape the future of media for many years. We’ve grown significantly in the past five years, and our creative and media practice has expanded around the world. We’re not slowing down anytime soon.

Our 50/50 split in tech and marketing ensures we deliver impactful, personalised, and creative media solutions, and our strategic consulting capabilities combined with world-class creativity, media, content and data, help clients achieve bold outcomes quickly. And, as the first full-service AI-native agency, we integrate AI into all our operations.

We surveyed 500 marketing leaders. Here are their top investments in digital

Today’s digital marketing environment is fraught with complexities and changes that demand brands demonstrate agility and foresight.

From AI transformation to macroeconomic pressures, external factors are shaping the strategies and decisions of marketing leaders worldwide.

Each year, we survey marketers to learn about the state of their digital marketing strategy investments, priorities, and goals. We’ve watched as brands adapt and integrate various marketing strategies to stay in line with their long-term goals while responding to the challenges impacting them most. This year, those challenges include:

- The impact of AI on marketing teams: Artificial intelligence (AI) is no longer just a futuristic concept but a present reality reshaping operations across businesses—especially within marketing teams. From automating routine tasks to enhancing customer personalisation, AI is becoming an invaluable tool. But the rapid pace of AI integration also comes with challenges, from skill gaps to implementation hurdles.

- Continuing inflation and economic concerns: Economic volatility, driven by persistent inflation and broader economic uncertainties, is forcing brands to reassess their budgets and strategies. And with profitability under pressure, marketing teams are focusing more on activities that offer the highest return on investment.

- The quest for profitability: Every dollar counts, and brands strive to strike the right balance between cutting costs and investing in growth. In this uncertain marketing landscape, many leaders are wrestling with and having to make hasty, consequential decisions that may directly impact their growth in the short-run—ultimately determining their long-term growth trajectory.

Our survey responses show that, unsurprisingly, the combination of these factors has brands leaning into the strategic and tactical choices they have more immediate control over. Three notable trends in brands’ digital marketing strategies stood out, so we explored what brands are doing (and how they can continue) to thrive now and in the months to come.

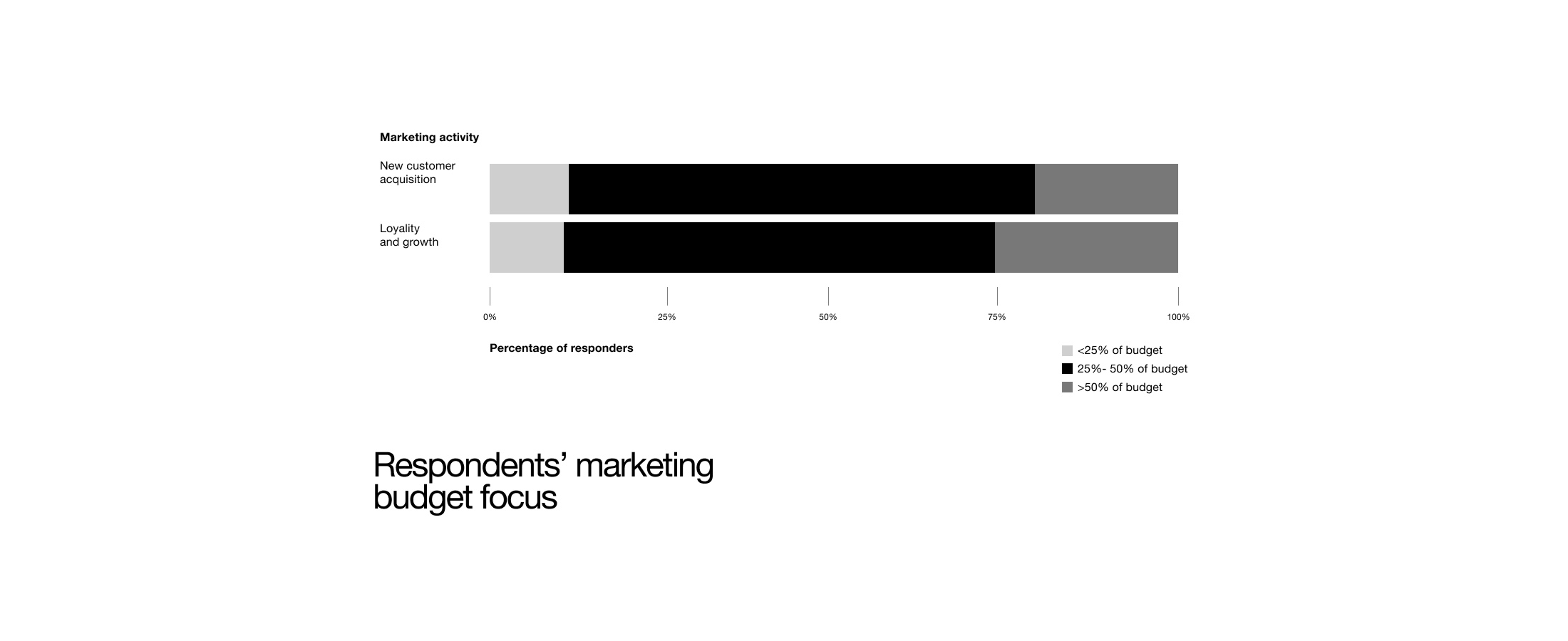

An increased emphasis on customer loyalty tactics

As the marketing landscape grows increasingly complex, so does the challenge of acquiring new customers. Our survey indicates a significant shift in strategy, with many brands pivoting from aggressive customer acquisition efforts to a stronger emphasis on customer loyalty and retention.

According to our survey, 64% of brands are investing heavily in loyalty rewards programs, while 62% are focusing on personalised email campaigns. Additionally, 54% of respondents are enhancing their customer service efforts to build and maintain strong relationships with existing customers.

This shift can be attributed to several factors, including rising costs associated with customer acquisition and a more competitive marketplace. With cost-per-click (CPC) rates and cost-per-acquisition (CPA) metrics climbing, it’s more cost-effective to focus on retaining existing customers rather than acquiring new ones.

Additionally, privacy concerns and the phasing out of third-party cookies make digital advertising and data collection more convoluted, prompting marketers to prioritise and nurture known customer profiles over investing in unknown prospects.

Brands are leaning more heavily into retention strategies due to the increasing complexity and cost of acquiring new customers

This is not merely a defensive move; it reflects a strategic decision to build deeper, more meaningful relationships with customers who already know and trust their brand.

Retaining an existing customer is often more cost-effective than acquiring a new one. By focusing on loyalty, brands can increase customer lifetime value and foster a community of brand advocates who can help drive word-of-mouth marketing.

To stand out in a crowded loyalty space, brands must innovate their approach to customer retention. This includes leveraging advanced data analytics to understand customer behavior better, personalising communication and offers, and ensuring exceptional customer experiences at every touchpoint. Building a robust loyalty program that rewards not just purchases but engagement can create a more dynamic and valuable customer relationship.

Enhance your loyalty programs by incorporating personalised rewards, exclusive content, and unique experiences that cater to your most valuable customers. Utilise data-driven insights to identify what motivates your customers and tailor your programs accordingly.

– Dowoo Lee, VP, Integrated Media Strategy & Planning

Investments in AI

The hottest buzzword and topic of internet debate, artificial intelligence continues to be a focal point for many marketing teams—and with a notable increase in investment this year. The focus has primarily been on GenAI for content and creative production, which for many brands is the most immediately available and applicable use case of the technology.

Our survey found that 78% of marketing teams plan to upgrade or enhance their AI capabilities this year. Of these, 76% are investing in GenAI, followed by 51% in creative production and 46% in data science.

While interest in AI is undeniable, many brands are still in the early discovery and education stages of adoption. According to eMarketer, a majority of marketers recognise AI’s potential but are lagging in full-scale adoption due to concerns over cost, integration, and expertise. The potential of AI to streamline operations, enhance personalisation, and drive creative innovation is clear, but practical implementation remains a challenge.

Brands recognize the value of AI and are eager to integrate it into their operations, but they are cautious about adopting it.

This caution is understandable given the rapid evolution of AI technologies and the need for substantial investment in both technology and talent.

For brands looking to harness the power of AI, a pragmatic approach is essential. While the potential of AI is vast, a gradual and measured approach to its adoption allows brands to mitigate risks, manage costs, and build internal capabilities without overwhelming their teams or resources.

Start by integrating AI tools within existing platforms to minimise costs and maximise familiarity. Focus on use cases that offer immediate, tangible benefits, such as automating repetitive tasks or enhancing personalisation. Experiment with AI in controlled environments to build confidence and understanding before scaling up. And consider partnering with AI specialists or platforms that can provide a tailored solution that aligns with your specific needs.

– Sam Huston, SVP Creative & Media

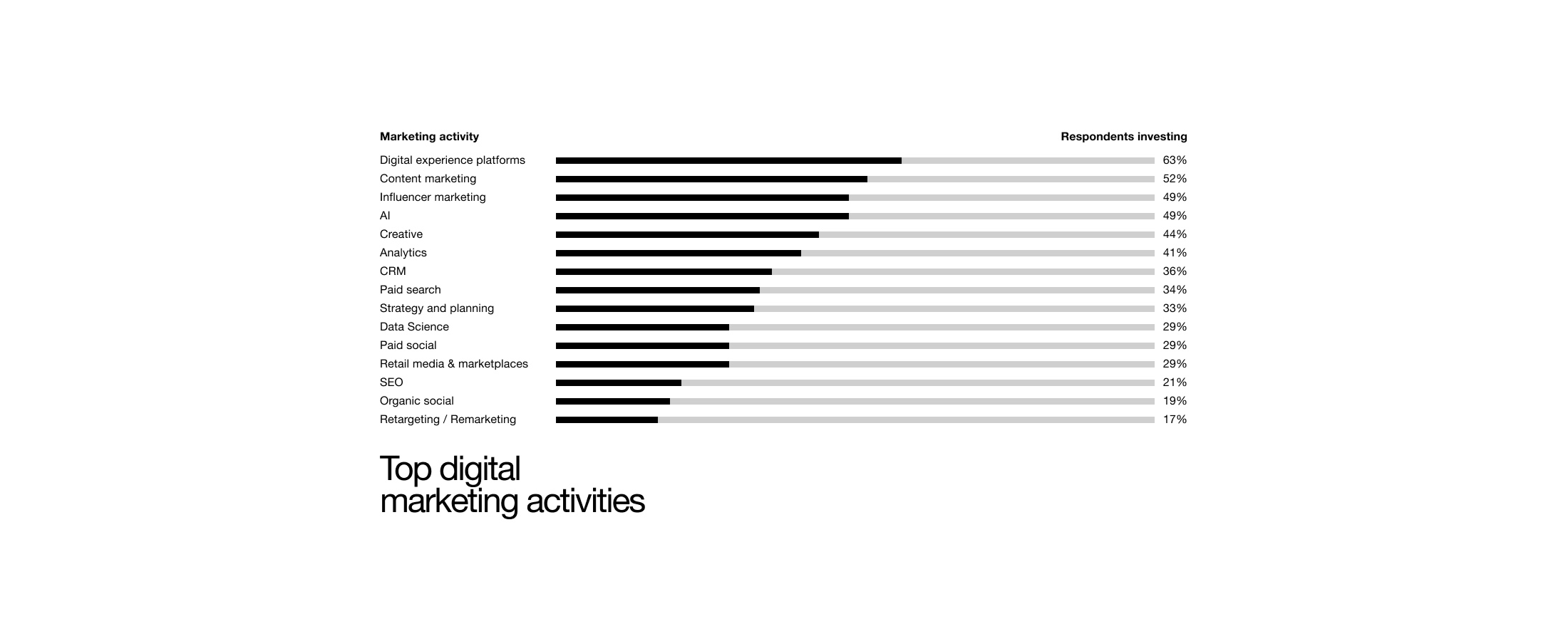

The increasing importance of content & creative

As algorithms and automation increasingly dominate many marketing processes, unique and personalised content and creative are becoming key differentiators. Producing engaging, high-quality, and distinctly human content is more important than ever.

This year, we saw a noticeable increase in investments in Digital Experience Platforms (DXPs), content marketing, influencer marketing, and AI-driven creative production.

In contrast, more traditional strategies like programmatic advertising, conversion rate optimization (CRO), retargeting, and organic social media are seeing reduced investment due to their diminishing effectiveness in the face of privacy changes and the deprecation of cookies.

The shift towards content and creative investments underscores the need for brands to forge stronger emotional connections with their audiences. As the effectiveness of targeting through cookies and other third-party data declines, marketers are focusing on creating compelling content and digital experiences that engage users directly and build long-term brand loyalty.

Increasing focus on content and creative reflects a broader recognition that brand experiences are essential for cutting through the noise.

Brands are opting to invest in the elements they can control directly, such as storytelling, creative execution, and personalised experiences. High-quality, relevant content can enhance brand perception and foster loyalty, while also providing SEO benefits.

Continue to prioritise content quality and creative innovation over quantity. Investing in a robust content strategy that leverages diverse formats—video, infographics, interactive content, etc.—can help maintain audience interest and engagement. Additionally, leverage influencers and user-generated content to provide authenticity and enhance brand trust.

– Molly Deaville, Growth Director

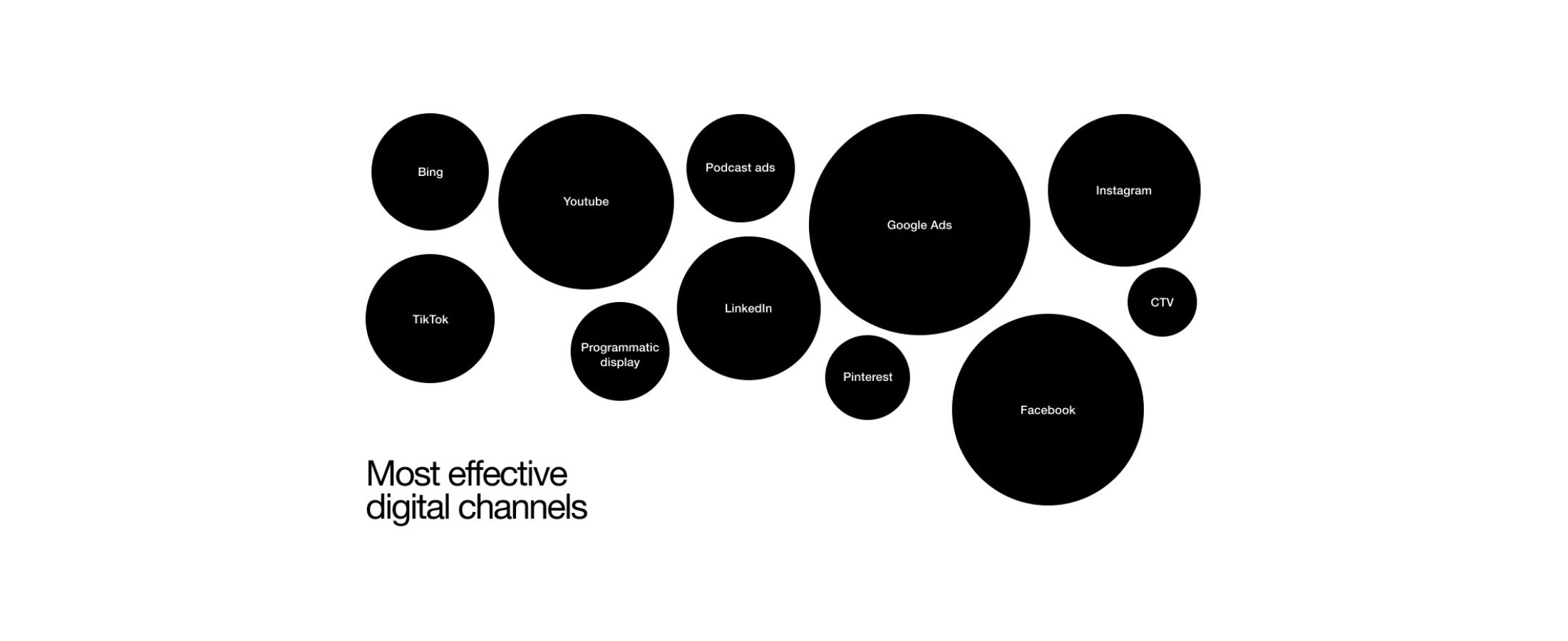

Digital channels: What’s working best

Brands are doubling down on digital channels that have consistently delivered strong results, giving less time, attention, and money to newer or less proven ones.

According to our survey respondents, this year’s most effective digital channels are Google Ads, Facebook, YouTube, Instagram, and LinkedIn. On the other hand, many respondents deemed channels, including programmatic display, TikTok, podcast ads, and connected TV (CTV), less effective.

In times marked by economic instability, brands are less willing to experiment with emerging or less predictable channels. Instead, they’re understandably focusing on platforms where they’ve seen historical success, have built established audience bases, and can feel confident about ROI.

The reliance on tried-and-true channels reflects a cautious approach to digital spending, driven by a desire to maximise return on investment amidst economic uncertainty.

However, this strategy could limit opportunities for growth and engagement with new audiences.

While investing in reliable channels is essential, brands should also consider experimenting with emerging platforms to diversify their digital strategy. Testing new channels on a small scale can provide insights into their potential without risking significant budget allocations. Additionally, optimizing current channels for better performance through advanced targeting and personalized content can enhance ROI further.

– Courtney Pierce, VP Demand Generation

Exploring new channels, refining AI strategies, and optimizing across the full funnel are essential steps to remain competitive and adaptable.

What’s next in digital marketing?

Brands are shifting from aggressive new customer acquisition to enhancing customer loyalty and retention, driven by rising acquisition costs and the need for more predictable ROI.

Companies are keen to invest in AI, but many lack the resources and skills to integrate it effectively and strategically. And a strong emphasis on authentic, audience-focused content and proven digital channels reflects a desire to connect more deeply with existing audiences amidst evolving privacy concerns and economic uncertainties.

In the short term, these trends suggest a slowdown in new customer growth for brands heavily focused on retention and cautious spending. But to build a robust marketing pipeline that supports long-term growth, businesses must balance these cost-cutting measures with some degree of experimentation. Exploring new channels, refining AI strategies, and optimising across the full funnel are essential steps to remain competitive and adaptable.

As we move forward into 2025, the key to success lies in the balance of embracing innovation while staying true to proven principles of customer engagement and loyalty. With the right strategy and support, marketing teams can thrive amidst uncertainty and drive sustainable growth well into the future—achieving both immediate results and long-term business objectives.

More insights

Questions?

VP, Integrated Media Strategy & Planning

Dowoo Lee

Why banks should think like a commerce brand

The financial exchange between an online consumer and a retailer depends on banks. However, the experience of that transaction occurs on e-commerce sites, mobile apps, or even on social media platforms.

Consumers have become accustomed to this process and the seamlessness of these experiences. They’ve grown to expect the same speed, convenience, and personalisation from their banks as they do from their favourite e-commerce sites.

Moreover, with social platforms like Facebook and Instagram having entered the game, customers have also become accustomed to the rapidly blurring boundaries between browsing and shopping.

To stay competitive, banks need to deliver experiences that match these elevated expectations and focus on experience- and discovery-based interactions.

The best way of doing that is to embrace the growing integration between banking and commerce, a road already being paved by disruptors like fintech companies and open banking initiatives:

- Fintech companies have challenged banks to enhance their digital offering through innovative and user-friendly financial solutions.

- Open banking initiatives have enabled customers to access a wider range of financial products and services from different providers through a single platform.

The opportunity

The rise of financial disruptors isn’t just a trend, it’s a wake-up call for banks to innovate and adapt. The good news, however, is that the benefits of investing in innovation can be huge.

By integrating commerce into their platforms, banks can provide a more seamless and convenient experience for customers: Users can manage finances, shop, redeem rewards, and access various financial products and services—all within a single ecosystem.

By creating a one-stop-shop for a variety of products and services banks can turn their platforms into places where customers want to spend more time. In turn, shifting focus from creating transactional utility to creating an engaging experience will lead to increased customer satisfaction and retention.

The financial benefits are also substantial. Participating in e-commerce transactions, offering loyalty programs, and facilitating transactions between customers and merchants all enable banks to tap into new revenue streams.

In turn, the wealth of data generated through an integrated experience like this provides invaluable insights into customer behaviour, helping banks craft more personalised financial products and targeted marketing strategies to drive engagement even further.

Unlocking success

If we think about the integration of e-commerce within banking as a spectrum, the most significant investment in that integration that banks could make would be to build their own e-commerce marketplace within their existing platform.

While this would streamline the behind-the-scenes process of online transactions and eliminate the need for third-party processors, this type of investment represents a massive leap forward for traditional banks. The risk vs. reward factor will likely remain too high for banks to realistically consider in the short term.

Fortunately, there are other types of investments that fall along the middle of the spectrum that are more realistic for banks to explore as a worthwhile experiment.

- Instead of integrating a full-scale marketplace into their platform, for example, banks could create a platform for their customers to redeem their credit card points and loyalty rewards. This simplified marketplace encourages engagement while enhancing the value of existing banking platforms—driving increased spending and loyalty.

- Banks could also double down on consolidating their financial products and evolving their platforms into cohesive digital ecosystems. This would create a centralised place for customers to manage everything from savings accounts and credit cards, to investment and insurance—simplifying financial management while positioning banks as trusted advisors.

- Personalisation poses perhaps the most low-risk/high-reward opportunity of all. By leveraging customer data and insights, banks can offer highly personalised financial advice, portfolio management suggestions, and tailored product recommendations—improving customer relationships in a big way while creating new avenues for cross-selling.

The future of banking

The future of banking is here—and it’s all about the seamless, integrated experiences that make life a little easier and a lot more connected. To this end, it’s time to stop looking at banking and commerce as separate entities.

By meeting the growing integration of banking and e-commerce head-on, banks can adapt to the evolving digital landscape, meet modern customer needs, and secure their place in an increasingly competitive industry.

Questions?

CTO – APAC & DEPT® Adobe Practice

Yash Mody

Ensure more people spend time with you

Today’s customer journey is complex, weaving in and out of digital touchpoints, physical stores, and retailers. Together, we can optimise and personalise these various touchpoints, creating customer experiences that drive awareness, growth, and loyalty for your brand.

Exceptional experiences at every touchpoint

We help you map your customers’ end-to-end journeys, uncovering the biggest opportunities to drive awareness, growth, and loyalty.

Personalisation—even at scale

We specialise in using data, automation, and AI to bring personalised experiences to the masses.

Seamless tech stack

We partner with all the leading DXPs to help you integrate and leverage technology to create better experiences.

Never one-size-fits-all

Every customer journey is different. We can help you track, analyse, and optimise the paths your audience takes to convert.

AI-driven customer insights

With AI, we can gain contextual insights into customer behaviours, preferences, and feedback, before quickly putting them into action.

Where consulting meets craft

With deep and broad experience in UX/UI, emerging tech, creative, data, and AI, we can move the needle for your business while giving your customers something to love.

Get in touch