New10: the creation of a corporate start-up

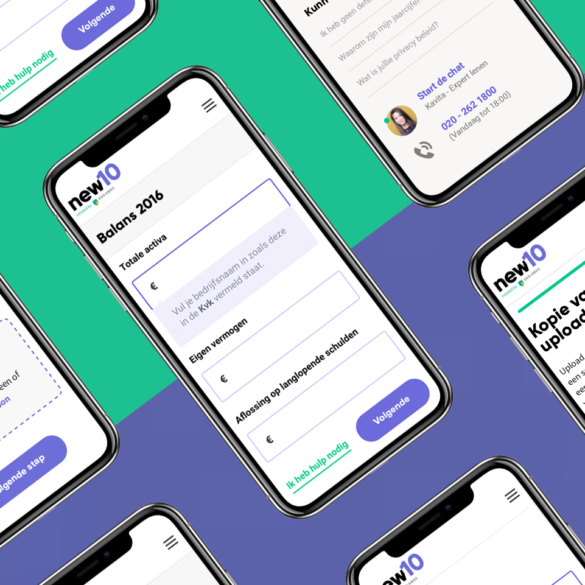

Want to know if you can get a loan within 15 minutes? And have it in your bank account two days later? All of it arranged online? No problem! Fintech start-up New10 offers entrepreneurs the best of two worlds: the flexibility of a start-up with the financial knowledge of a bank. Together with ABN AMRO’s business experts, DEPT® has created New10: a new digital platform and an in-house dream team.

The landscape of SME financial services is undergoing rapid changes. So many new (Fintech) players are entering the market that it is hard to keep up. ABN AMRO did not want to miss out on these developments. But how? The decision was made to start up an initiative outside the structures of the bank, an idea that could be tested over a short period of time – with learnings that could be fed back to the parent bank – and that could ultimately be developed into a platform for growth.

From memo to demo

It all started with a memo drawn up by Patrick Pfaff, ABN AMRO’s Director of Commercial Banking Clients, in which he called attention to the market developments and emphasised the need for ABN AMRO to respond to them. The kick-off of the New10 project took place in December 2016 in a tiny room with people from various departments of the bank – modelling, risk management, customer focus and architecture – and people from McKinsey. There was an idea and a clickable prototype. The goal was to identify and define personas, pain points and a blue sky in a two-week sprint. Based on market research by New10 and MICompany conducted among more than 900 entrepreneurs and conversations between XXS Amsterdam and a number of entrepreneurs, the assumption arose that an entrepreneur wants to be able to go on building his business without hassle and wants an instant answer to the question: “can I borrow here?” In other words, without first making an appointment, showing a passport, or drawing up an entire plan. Clarity. Immediately.

Jaap Boersma, New10 CTO, explains: “Applying for a business loan is a process that takes a lot of time and energy and we wanted to reverse this. Everyone wants to know whether it’s ‘yes’ or ‘no’ right away. So, we literally reversed the process, which is usually very long and has uncertain results. Our objective is to provide entrepreneurs with clarity within 15 minutes.”

Collaboration

After three two-week sprints, we were finally able to start the physical development process in December 2016. The ambition was to launch the product in September 2017. Realising that ABN AMRO could not go it alone, we looked for a party that could help us build an online platform.

Jaap continues: “The extremely fast launch, the design principles, the use of new techniques, and ensuring everything was fully cloud native and compliant-by-design made it pretty hard to find parties experienced in all of these matters. We were also looking for a match in human terms. It meant partnering up with DEPT® was pretty much a matter of course, really.”

Bart Manuel, DEPT® CTO and founder, comments: “The first two days we were together were mainly spent on team building in order to create a foundation for an open, honest and personal relationship. There were many known unknowns, which is something both parties knew, and therefore it was important that we were able to accept each other’s uncertainties and were willing to learn from each other. Instead of bandying about quasi-certainties, we also discussed what we did not know, which is why it was so important that the teams clicked.”

Time pressure

Due to the fast-moving market and the mission to be innovative, a lot of work had to be done in a short period of time. This required a close-knit team of internal and external talents who could move quickly and work towards the same goal: putting the user centre stage.

Connecting these talents in the fields of creativity, data and technology was the first step, but it was also essential to work together as efficiently as possible. That is why a lot of time was spent linking goals to team sprints, joint huddles and sprint reviews with all partners.

Jaap adds: “The period of time we had to achieve this (Dec ‘16 – Sept ‘16) was so short that it was only possible to succeed if we were actually together. There were many iterations. For example, we initially designed a conversational UI, but we discarded that one altogether. To optimise the conversion, we made a lot of adjustments later on. We had a lot of staffing problems. As a result, we required a lot of extra effort, stability and quality to be able to start the beta period. Later on, we went through another one of these cycles based on input from customers. We finally completed the beta version in May.”

Learnings

When you work according to the lean start-up approach, you go live with an MVP and then continue work on the product based on feedback. It was different in this case, however. Due to the strict banking regulations, everything had to be tested and operative before the time of the launch. This made it harder to adjust things later on.

Bart comments: “We put together an end-to-end, fully operational bank in 10 months’ time. Obviously I would do things differently if I had the chance to do it again – even more MVP – although that remains difficult with all the regulations and conditions you have to comply with. You are creating a bank, after all.”

To which Jaap adds: “Now, we try to implement new features immediately.”

What do we have so far?

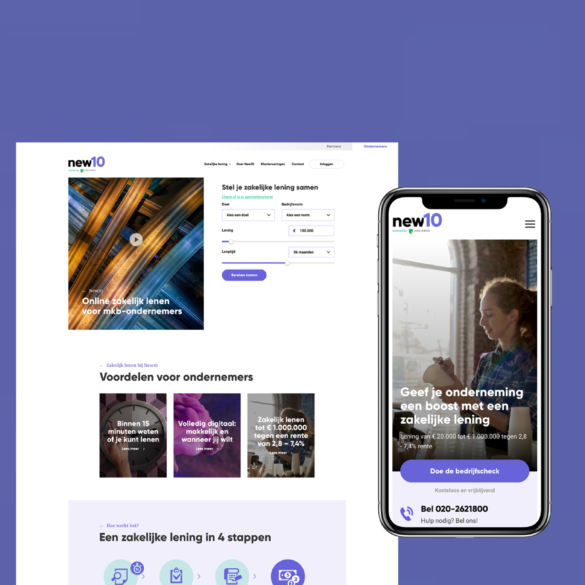

An organisation has been set up. A brand. For a (corporate) start-up, brand-building is as important as ever. In fact, it can make all the difference. That is the reason why DEPT® worked closely together with the founders to develop and design the name, positioning, brand story, pay-off and visual identity of New10. In the visual translation, a balance was sought between trust, speed and the ‘trendiness’ of a new start-up. After the launch, the brand was further expanded with the help of parties such as XXS and Storm Digital.

In a time-to-market of less than a year, a platform was created that enables an entrepreneur to find out within 15 minutes whether he can get a loan and what the interest and conditions would be. Drawing people towards the product is quite a task in itself, however, and this was something everyone at New10 had to learn as well.

Jaap says: “We keep getting better. We went for it straightaway and built up the brand, marketing and service all at the same time. Make no mistake; doing all of this simultaneously was an incredible challenge. We went through the switch from a change-organisation to change and run. We have customers, there are live products and we run campaigns, so the whole dynamic has changed. We are constantly working on improving the front end to make it easier to use.”

Bart says: “If you think you can create something perfect in one go, you are kidding yourself. Through our personal service, we found out that customers understood very well that everything doesn’t always work flawlessly from the start. It is important that you fix these issues, however, and make sure they don’t become the customer’s problem. We noticed that customers wanted to help us because they realised that we were doing our utmost to turn everything into a success together. Based on the use of the platform by customers, we could start an iterative process. After all, things don’t truly get real until everything goes live.”

New10 operates based on a learning mentality. The ambition is to continuously set the new standard in the field of business loans. In order to succeed, everyone at New10 must be willing to enter into a learning process with one another and with the entrepreneurs, and to always strive for that perfect ‘10’ in their own name.

Growth vs. Scalability

New10 consists of a small group of people and would like to keep it that way. However, the go-live and the increase in customers have also added a number of responsibilities. To remain scalable, many processes – from monitoring to login – have been automated. Any task that would normally take up a lot of time, in fact.

Bart explains: “You have to ensure that the turnover and the number of customers increase, while your organisation and costs stay the same. But you do need to invest in this, so it is pretty complicated.”

Jaap adds: “You have to continually invent and improve yourself. Is it possible to improve the process, the method, the framework or the code? And then we have to implement it all. But it is a double-edged sword because you want to be able to continue to innovate on the basis of stability. We are keen on diversity, but we don’t want too many flavours, and we want to be able to offer the flavours we do have properly.”

Privileged position

Start-ups often have to make ends meet and tend to spend a lot of time trying to get together enough money. New10 has a privileged position in this respect, since it has ABN AMRO as an investor.

Jaap says: “Some Fintechs stand on their own, some do not. We provided the kind of knowledge about credit risk that only experienced banks have. Our risk model is so solid that we are able to offer very reasonable interest rates. The bank was pondering the questions of ‘how can I be more innovative? What is going on in the market where innovations are concerned?’. There is a certain distance between New10 and its parent, but it is close enough to take advantage of its expertise and know-how. New10 has a new face and a different character and thus has enough room to explore and find out what fits best.”

The bank is a prudent shareholder and wants to know what goes in and out. It has its own login for New10’s dashboards and reports and ABN AMRO’s people regularly visit us. We keep everything as transparent as possible.

Jaap says: “They now know that this concept is actually feasible. But the key question is: how do you combine everything into an operational product? I am glad to say that we managed to find the right balance.”

Bart says: “This is a fantastic way to innovate for any corporate entity. A pocket on the outside, yet close to itself. Not just an experiment, but a platform from which valuable insights can be gained.”

New10 in the land of corporate start-ups

New10 distinguishes itself from other corporate start-ups through its conviction and it is setting an example in this respect.

Bart comments: “You really feel it all the way up to the highest echelons of the bank. People are approachable, realistic and prepared to act as a barrier if necessary. Nobody is nervous because the future looks great. You can really feel that conviction, which makes it very special. Everyone in all departments and on all levels is deeply invested, and that is something you don’t see very often.”

Jaap adds: “Of course, it wasn’t all plain sailing because, otherwise, anyone could have done it. I am still amazed that we shouted ‘Hey, we’re going live in September’ and that we actually did it. We had gathered people with plenty of tenacity and focus, which is why when we hit a snag, we were always able to think of something to deal with it or get around it.”

Has new10 been a success? And what does the future hold?

Even though New10 started off as an idea, ABN AMRO is increasingly treating it as a centrepiece of the commercial banking strategy.

Jaap explains: “We’re taking bits of innovation back to the bank as building blocks to improve the banking processes. New10 is a spider in the centre of a web in this respect. At the same time, for us, New10 is a success when the number of customers increases, since this proves that customers approve of our proposition. Our direct channel is currently running smoothly. In addition, we have identified many more opportunities in the SME financing market in which New10 could play a role.

We don’t just want to finance; we want to develop new products together with partners, too. At the moment, we are doing this with a party that works in credit management. We need to continue to innovate. We can deliver, learn digital capabilities, adapt and take any steps required in no time at all. This allows us to reinforce the things the bank is good at by using the things we’re good at. While a bank is a huge force where risk management and asset valuation is concerned, we are great at running digital capabilities like APIs.”

So, the focus of New10 is not just on customer numbers, but also on innovation. Sure, it must yield something, but to New10, continued innovation is crucial. There will be a PSD2 wave soon, for example, and banks really need to ride that wave. In fact, New10 wants to be the first to take advantage of it. Figures and innovation go hand in hand in that respect.

Customer feedback

Customers are very positive about New10. Below is a brief selection of their comments:

“Applying for a loan at New10 is easy, quick, instantaneous and reliable.”

“Fantastic service. The people on the phone are nice and love contributing ideas!

“Borrowing online is fast and easy now. No need to set a foot out the door. :-)”

“I heard the advert. The fact that everything can be done online is very convenient, and everything is sorted very quickly.”

More Insights?

View all InsightsQuestions?

Founder